Embily Card

Börsen-Gebühren

Finanzierungsmethoden

Unterstützte Krypto-Währungen (8)

Embily Card Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a crypto debit card, you can. This is a review of Embily Card, one of the crypto debit cards out there

Embily Card Video Review

Tired of reading? No problem, check out our video review of the Embily Crypto Debit Card here!

General information

Embily Card is an interesting new card. The card is formally regulated by the Estonian financial authorities, as the parent company is Estonian (Embily OÜ).

The Embily Card is intended to be used by both new crypto investors, familiar investors, crypto adopters and globetrotters. The card has attractive functionality for each and every one of these groups.

Users can have up to 5 Embily Cards, and connect them to Apple Pay or Google Pay.

VISA

Embily Card is a VISA card, meaning that you can use the card at any point of payment that accepts VISA. This is of course a great advantage, seeing that VISA is the most widely accepted card in the world (alongside Mastercard).

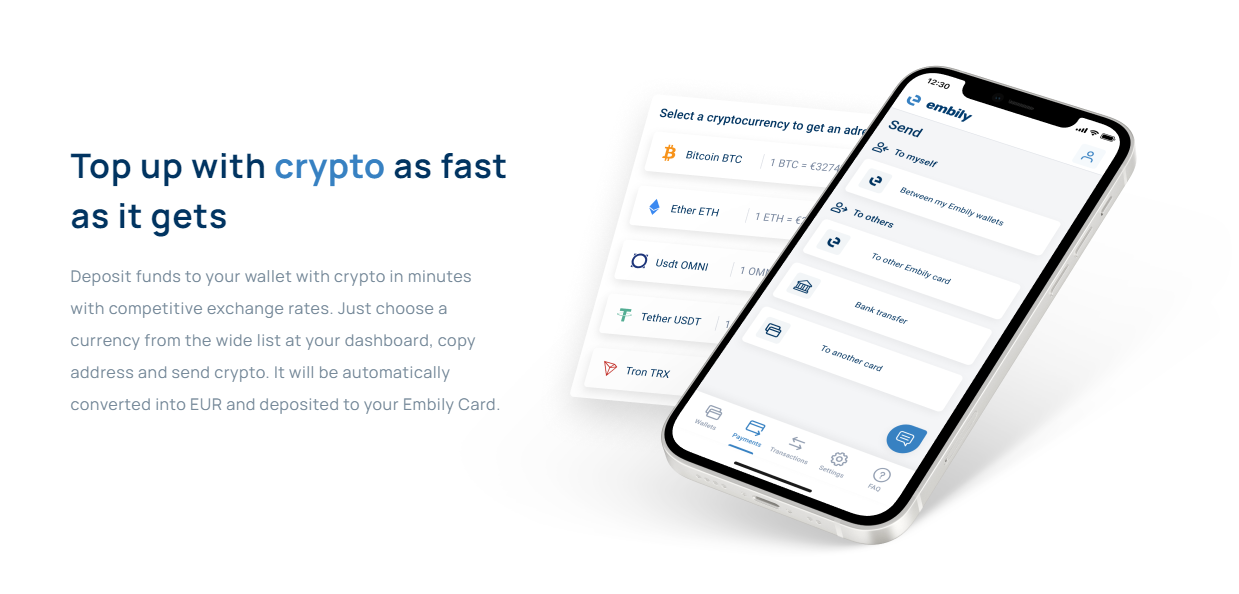

Supported Cryptos

The card currently has support for the following assets/transfers:

- BTC

- ETH

- BNB

- TRX

- DAI

- USDT ERC20

- USDT OMNI

- USDT TRC 20

- USDC

- IBAN transfer for legal entities

- For b2b — IBAN transfer with distribution to customer cards

Please note though that no card holder is required to hold tokens or buy coins.

Picture of Card

There are two versions of the card: plastic and virtual.

The plastic will of course need to be ordered and shipped before its possible to use, but the virtual card will be ready in just 5 minutes from ordering.

The plastic card costs EUR 15 (shipping is free of charge), but if you order through this link it comes with a EUR 10 deposit bonus, so in reality it is only EUR 5.

The price for the virtual card is EUR 6, but if you order through this link it comes with a EUR 5 deposit bonus.

Friendly and Easy Referral Program

Embily Card also has a referral program. When you refer a friend to the Embily Card, he/she gets a USD 10 discount for plastic cards and 5 USD discount on virtual cards (as mentioned above), and you as a referrer will get the same bonus and 0.10% from their topped up amount.

Restricted Jurisdictions

Embily is currently focused on the distribution of cards in the EU market. If you are not a resident of the European Union and EEA countries, you can still use other Embily products (such as their wallet).

For any non-EU people interested in getting a crypto card, we recommend you to use our Debit Card List to find another crypto card for you.

Embily Card Cashback

What is a cashback feature? Well, it's actually quite simple, every time you use the card, a percentage of what you pay with the card gets transferred back to you, normally in the form of tokens.

Embily Card does not currently have a cashback function, but according to information provided to us here at Cryptowisser.com, this function "is planned in the near future".

Embily Card Fees

Embily Card’s fees are fairly competitive.

There is a monthly fee of EUR 2.00 per month. This fee is charged within 24-48 hours from when the card has been activated on the website. Any following monthly fee charges will be made on the same day each month.

The most important fee of them all is the commission on spending. Embily Card doesn't really have a commission on spending as far as we know. Loading, however, comes at a fee of 1.00%, so this practically becomes a spending commission, as you can't spend without loading.

There is an additional "spending commission" for transactions you make outside of the card's currency, where the company charges a 1.50% Foreign Exchange Charge. This is quite standard among crypto debit cards.

The Embily Card charges no commission for cash withdrawal in ATMs in Europe, only a flat 1.50 EUR fee per withdrawal.

Here's the full list of fees for the Embily Card:

Embily Card Limits

The following are the limits to using the card in EUR. The Tier-levels set out in the picture are different levels of KYC. The more information you have provided, the higher Tier-level do you get. The below limits are for the lowest level, Tier 1:

Concluding remarks

If this is the cryptocurrency debit card for you, congratulations. Get one, including EUR 10 deposit bonus + free home delivery, by clicking here.

But if not, check out one of the other cards in our crypto debit card list.

Good luck!