Bamboo Relay

Frais de l'echange

Méthodes de dépôts

Cryptos prises en charge (37)

UPDATE 11 January 2023: We have noted that there has not been any trading volume on Bamboo Relay for quite some time. Moreover, they haven't posted anything in their social channels.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

Bamboo Relay Review

What is Bamboo Relay?

Bamboo Relay is a decentralized exchange (DEX), or more precisly a “relayer for decentralized protocols”, that launched in 2017. The exchange is powered by 0x Trading, and you need to connect a wallet (such as MetaMask) to be able to trade here at all. The platform is built on the ETH-blockchain.

The founder and “product dev” is named Joshua Richardson.

US-investors

Based on the info on this exchange’s website, US-investors can trade here. Any US-investors interested in trading here should in any event form their own opinion on any issues arising from them being from the US.

General information on DEXs

DEXs are becoming increasingly more popular, mostly due to the following factors:

- They do not require a third party to store your funds, instead, you are always directly in control of your coins and you transact directly with whoever wants to buy or sell your coins.

- They normally do not require you to give out personal info. This makes it possible to create an account and right away be able to start trading.

- Their servers spread out across the globe leading to a lower risk of server downtime.

- They are essentially immune to hacker attacks.

However, DEXs normally have an order book with lower liquidity than their centralized counterparts.

Bamboo Relay Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should decide for yourself which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. The below is a picture of the trading view at Bamboo Relay:

Bamboo Relay Fees

Bamboo Relay Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers are so named because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

Bamboo Relay's trading fee for takers is 0.20%. Makers enjoy a discount on the trading fee and they trade for half the taker fee, so 0.10%. These fees are below, or in line with, the industry average which has historically been 0.25% but is now creeping towards 0.10%-0.15%.

Bamboo Relay Withdrawal fees

Apparently, Bamboo Relay does not charge any withdrawal fees either (for orders other than Ethereum or 0x, these orders incur standard network fees). This is a very strong competitive edge in the market if true and really distinguishes this exchange from most other market options.

All in all, the fees charged by Bamboo Relay, or rather, the fees not charged by Bamboo Relay, is an extremely competitive edge with this exchange.

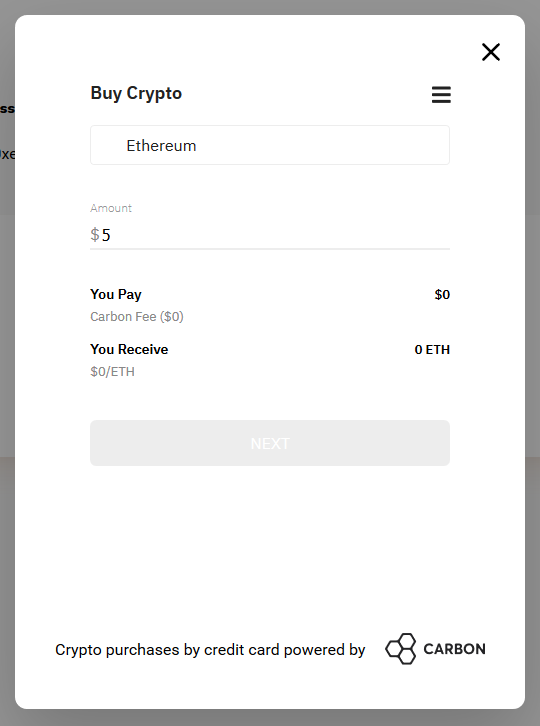

Deposit Methods

Bamboo Relay accepts deposits of fiat currency via credit card (but not via wire transfer). Most other DEXs does not accept any deposits of fiat currency at all. This exchange’s credit card deposits are made possible through the cooperation with the company Carbon. By enabling credit card deposits, Bamboo Relay also qualifies as an “entry-level exchange”, meaning an exchange where new crypto investors can take their first exciting steps into the thrilling crypto world.

Bamboo Relay Security

The servers of DEXs normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange. That is, until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges.