BTCC

Exchange Fees

Deposit Methods

Cryptos (56)

BTCC Review

What is BTCC?

BTCC is one of the oldest cryptocurrency exchanges worldwide. It is widely praised for its reliability, security, liquidity and extra services it provides for its users.

The exchange was initially established in Shanghai back in 2011. It was then one of the big three Chinese cryptocurrency exchanges. The other two were Huobi and OKCoin. BTCC underwent a significant restructuring in 2018, closing its offices in China and expanding its business globally since then. The exchange is currently headquartered in the United Kingdom.

Futures Trading

BTCC specialises in providing futures trading service. You can trade two types of crypto futures on BTCC which are namely USDT-margined futures, which are settled in USDT, and Coin-margined futures, which are settled in cryptocurrencies. Currently, the exchange offers perpetual futures trading on more than 60 trending coins, including BTC, ETH, DOGE, XRP, SOL, and many more.

Tokenized Futures

In 2022, BTCC launched commodity and stock tokenized futures. Users can diversify their portfolios by branching out to other financial instruments other than cryptocurrencies with the exchange. All tokenized futures are settled in USDT.

BTCC Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at BTCC:

BTCC Fees

BTCC Trading fees

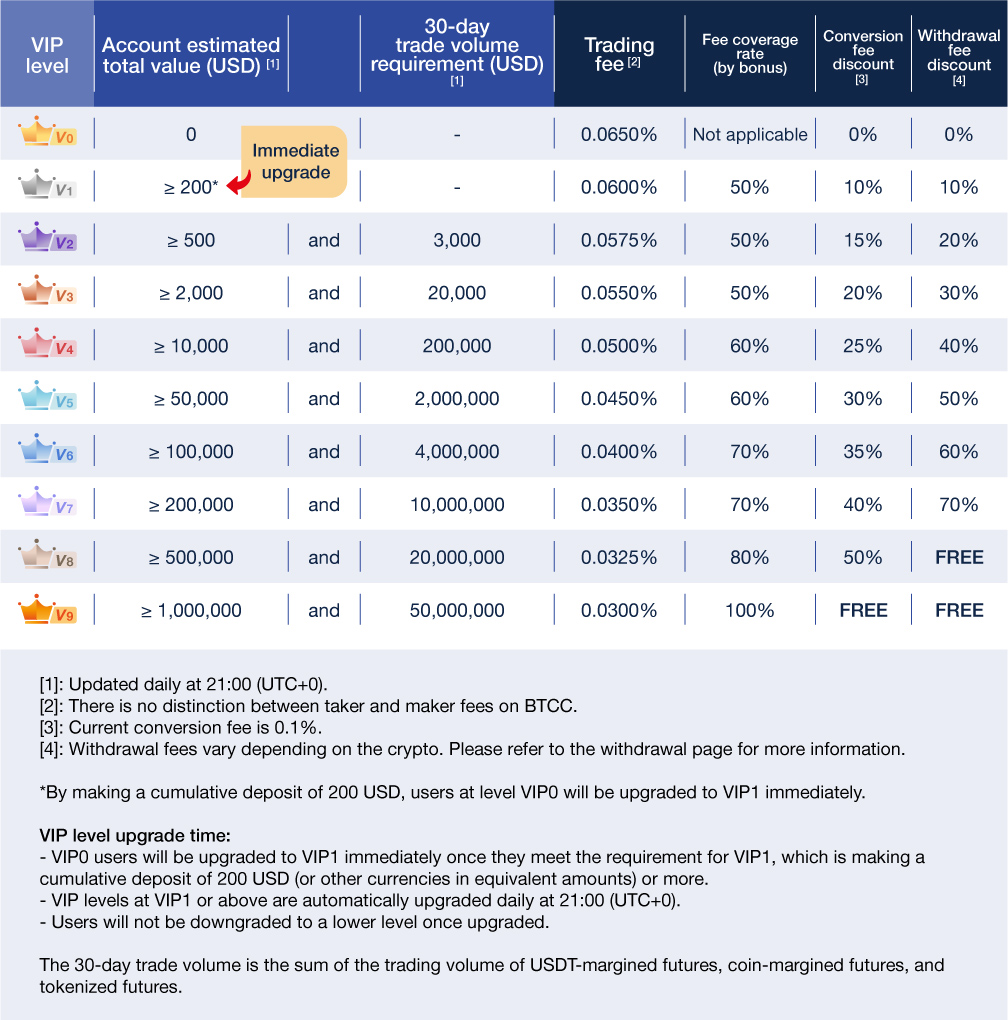

Most crypto exchanges charge two different types of trading fees: taker fees and maker fees. The taker is the person who picks up an existing order from the order book. The maker, on the other hand, is the person who creates an order that is not immediately matched against an existing order on the order book. Makers are often rewarded for creating liquidity on the platform by a lower trading fee than takers. Exchanges that do not make a distinction between takers and makers charge what we call “flat fees”. BTCC charges 0.06% for both takers and makers.

According to the largest and most recent empirical study on crypto exchange trading fees, the average spot trading taker fee is currently 0.2294% and the average spot trading maker fee is currently 0.1854%. Compared to those average trading fees, BTCC's taker fees and maker fees are way below the industry average.

Users can get discounts on trading fees by upgrading their VIP levels. A complete VIP fee table can be found in the picture below:

BTCC Withdrawal fees

The exchange charges a withdrawal fee amounting to 0.0004 when you withdraw BTC. This is also below the industry average, being 0.0004599 BTC per BTC-withdrawal according to the abovementioned report. Also here, users can get discounts on withdrawal fees by upgrading their VIP levels, as set out in the below picture:

Deposit Methods and US investors

US-investors

The exchange does not forbid US-investors from trading on its exchange. Regardless, all US-investors should do their own independent assessment of any problems arising from their residency or citizenship. In a worst-case scenario, they may not be able to trade at this exchange in spite of not being prohibited.

Deposit Methods

At this exchange, you can deposit through both credit cards (Visa/Mastercard) and cryptocurrencies. You have all cards on hand so to say. This can be very helpful, especially for newer crypto investors.

Demo Trading

The exchange provides all users with a non-expiring demo trading account. Upon registration, each user will find 100,000 USDT in virtual funds for them to practise trading.