BTCEXA

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (27)

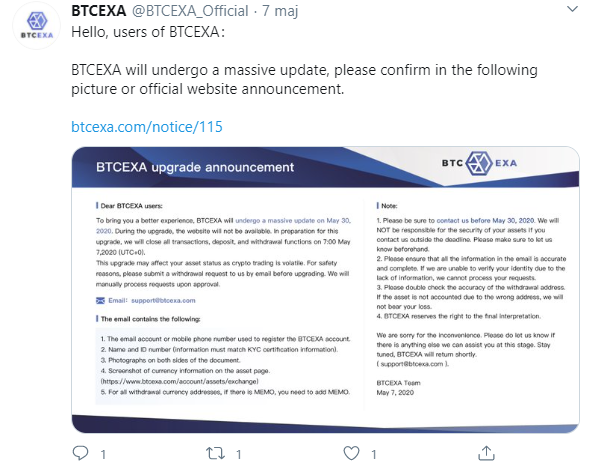

UPDATE 1 September 2020: BTCEXA has, since 30 May 2020, undergone what the exchange itself refers to as a "massive update". On the date hereof, the website is still down. Accordingly, we have marked it as "dead" and moved it to our Exchange Graveyard. We will revive it and move it to our Exchange List as soon as the exchange is back up.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

BTCEXA Review

BTCEXA is a cryptocurrency exchange registered in Australia and monitored by the Australian Financial Regulator. There are a few other cryptocurrency exchanges in Australia as well actually. The list includes (without any particular order) Bamboo Relay, BW.com, LocalEthereum, CoinJar, CoinSpot, Independent Reserve, CoinTree, BTC Markets and CoolCoin.

BTCEXA markets a few things as advantages with its platform. For instance, they aim to provide all the information on the listed tokens that a trader might need to make trading decisions. They emphasize that the exchange is regulated in Australia. Access to suitable APIs and “unparallelled vault security” is also highlighted as advantages with this particular trading platform.

This exchange also has a referral program. However, to our understanding, your referral commission will never be an actual payout. Rather, the referral commission will be a discount on trading fees. Naturally, these types of referral programs are less lucrative and attractive to its users than the regular ones. It is worth noting here though that only 1 out of 4 exchanges or so have referral programs at all, so the below offer is always something.

US-investors

BTCEXA does not list US-investors as prohibited from trading. However, US-investors should do their own independent assessment of any problems arising from their residency or citizenship.

Leveraged Trading

BTCEXA offers leveraged trading on its platform. This means that you can receive a higher exposure towards a certain cryptocurrency’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms essentially means that you borrow from the exchange to bet more.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

BTCEXA Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at BTCEXA:

BTCEXA Fees

BTCEXA Trading fees

Trading fees are naturally very important. Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges charge what we call taker fees, from the takers, and what we call maker fees, from the makers. The takers are the people who “take” orders from the order book. This means that they remove order options from the order book and thereby remove liquidity. Makers are the ones who put the orders on the order book in the first place.

The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

At BTCEXA, they don’t divide between takers and makers, but they charge flat fees: 0.20% of the order value.

0.20% is in line with, or maybe slightly higher, than the current industry average. Industry average has for a long time been 0.25%, but we are currently seeing a shift towards lower fees. Many exchanges now charge e.g. 0.10% or 0.15% instead.

BTCEXA Withdrawal fees

BTCEXA charges a withdrawal fee amounting to 0.001 BTC when you withdraw BTC. This fee is roughly in line with the global industry average, which is arguably 0.000812 BTC per BTC-withdrawal.

All in all, with respect to fees, BTCEXA is in line with industry averages.

Deposit Methods

BTCEXA does not accept any deposits of fiat currency. This means that new cryptocurrency investors (i.e., investors without any previous holdings of cryptocurrencies) can’t trade here. In order to purchase your first cryptocurrencies, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency. Find one by using our Exchange Finder!