Independent Reserve

Taxas da Bolsa

Métodos de Depósitos

Criptos Suportadas (13)

Independent Reserve Review

What is Independent Reserve?

Independent Reserve is an exchange from Australia. It launched as early as in 2013 and today it has over 100,000 customers from Australia and New Zealand.

This exchange claims to be committed to institutionalising the Digital Currency industry. They are a Gold Certified industry member of the Australian Digital Commerce Association (ADCA), which provides some extra legitimacy. The exchange has worked together with ADCA and also AUSTRAC (the Australian Transaction Reports and Analysis Centre) to develop a regulatory framework for the cryptocurrency exchange industry.

Airmarshal™ Platform

The technology behind the exchange is the exchanges own Airmarshal™ platform. This platform allegedly provides a secure, robust and scalable system for trading.

Mobile Support

Independent Reserve has a mobile trading app available for both iOS and Android devices. Users can buy, sell & store cryptocurrencies as well as track portfolios and price movements on the user-friendly app. Made for beginners and pros alike, trades can be placed fast and securely. Simply create a free account, deposit funds and users can begin trading in minutes.

US-investors

US-investors may not trade here, so if you are a US-investor and want to trade here, you’ll have to reconsider your choice of trading venue and choose one of the other top crypto exchanges. Don’t be too sad though, there are many other venues that offer the type of trading this exchange does. Use our Exchange Finder here to find out which alternatives you have.

Independent Reserve Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the quite limited trading view at Independent Reserve:

Cryptocurrency Tax Estimator and Independent Reserve OTC-desk

This review would not be complete if we had not also mentioned two features of this exchange that they are proud of. And rightly so. The Cryptocurrency Tax Estimator and the Independent Reserve OTC-desk.

The crypto tax estimator developed by KPMG is a digital tool that plugs directly into Independent Reserve’s user interface, allowing traders to estimate tax obligations on their portfolio all with just the click of a button. The crypto tax estimator is an Application Programming Interface (API) that enables Independent Reserve to provide their users an estimate of their potential tax exposure in real-time, based on the users’ buy/sell transactions on the exchange. The tool covers all cryptocurrencies exchanged on Independent Reserve, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and XRP.

The OTC-desk is a premium feature for “high net worth and institutional clients” that require execution of large volume trades in major cryptocurrencies. Its main features are clearly set out in the below picture:

Independent Reserve Fees

Independent Reserve Trading fees

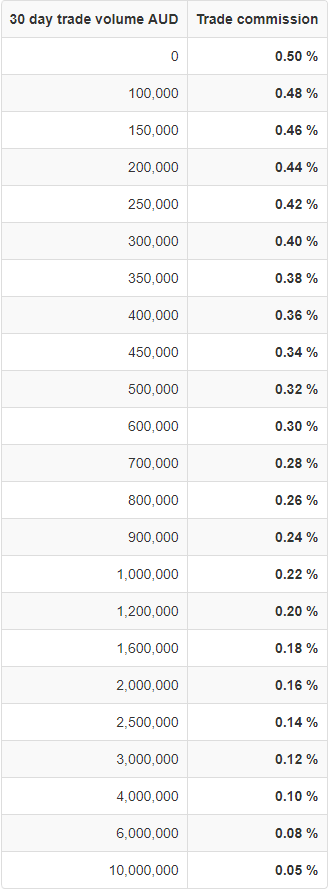

This Australian coin exchange doesn’t charge different fees between takers and makers. Their fee model is instead something we call a “flat fee model”. Independent Reserve offers a flat trading fee of 0.50%. For investors who prefer to pick-up existing orders from the order book, this might also be an attractive trading fee model.

There are many exchanges in the world that also have trading fees that decrease as volumes increase. This means that the exchanges gives you incentives to trade in higher volumes. The fees listed in this review and in the comparison table are excluding any such volume discounts. However, Independent Reserve also offer discounts for high volume traders. The trading fee volume discounts for Independent Reserve are as set out in the below picture:

Independent Reserve Withdrawal fees

Independent Reserve also charges a withdrawal fee amounting to 0.0003 BTC when you withdraw BTC. This fee is substantially below the global industry average. Global industry average is at 0.000812 BTC, so this exchange slashes that fee and charges less than 40% of the industry average. This is indeed very competitive.

Deposit Methods

This exchange offers wire transfer as a deposit method, but you can’t deposit via credit card. Offering wire transfer enables people with no previous holdings of cryptocurrencies to start off their trading career here, which is very helpful. Speaking of helpfulness, Independent Reserve actually also makes it possible for international clients to deposit to their respective accounts at the exchange via SWIFT-transfers. This is surely helpful for a lot of traders.