Joyso

Комиссии биржи

Методы внесения депозита

Поддерживаемые криптовалюты (69)

UPDATE 30 June 2021: Joyso has closed down its operations. They announced this through the following message on their website:

JOYSO Decentralized Exchange platforms are shutting down on 30 Jun, 2021

To all JOYSO users, in order to ensure we, Consensus innovation, are compliant with Taiwan’s upcoming cryptocurrency Anti-money laundering regulation that will be implemented on July 1st, 2021, the company will cease the provision of the following services: ETH JOYSO Decentralize Exchange and TRON JOYSO Decentralize Exchange at 16:00 on June 30, 2021. Both platforms will no longer accept any deposit, transaction and withdraw afterwards. All Users should withdraw all assets from both platforms before 16:00 on June 30, 2021.

Please take note that after June 30, 2021, Consensus innovation shall not be liable for any loss of profits whether incurred directly, indirectly, incidental, or any intangible losses if users calling smart contract functions to withdraw. Users will be able to continue trading tokens, JOY, T1 – T6 via UNISWAP after June 30, 2021.

While it is sad to say goodbye to both our decentralized exchange platforms, we need to ensure our continued compliance with developing industry regulations and are eager to focus our attention on the future development of more decentralized applications, and exploring new ways to use these blockchain technologies. We are extremely sorry for any inconvenience in this regard but thank you all for your continued support and understanding !

Accordingly, we have marked the platform as "dead" in our Exchange Graveyard.

To find a reliable exchange where you can start an account, just use our Exchange List and we'll help you find the right platform for you.

Joyso Review

What is Joyso?

Joyso is a decentralized cryptocurrency exchange (DEX) that launched in 2018.

Team

When looking at the team behind Joyso, we can only obtain info on the three top managers, the CEO, the COO and the CTO. The website does not present any info on these managers respective experience either, so there’s definitely some room for more complete info here. But these are the guys in charge:

US-investors

US-investors may not trade here today. Accordingly, if you’re a US-investor and you’re in love with Joyso, you’ll have to wait. In the meantime, use our Exchange Finder to find out which exchanges that support US-investors.

Trading Volume

On the date of last updating this review (16 November 2019), CoinGecko reported that Joyso had no trading volume at all. Naturally, this info is quite worrying.

General Information on DEXs

DEXs are becoming increasingly more popular, mostly due to the following factors:

- They do not require a third party to store your funds, instead, you are always directly in control of your coins and you transact directly with whoever wants to buy or sell your coins.

- They normally do not require you to give out personal info. This makes it possible to create an account and right away be able to start trading.

- Their servers spread out across the globe leading to a lower risk of server downtime.

- They are essentially immune to hacker attacks.

However, DEXs normally have an order book with lower liquidity than their centralized counterparts and if you lose your password, it is probably lost forever.

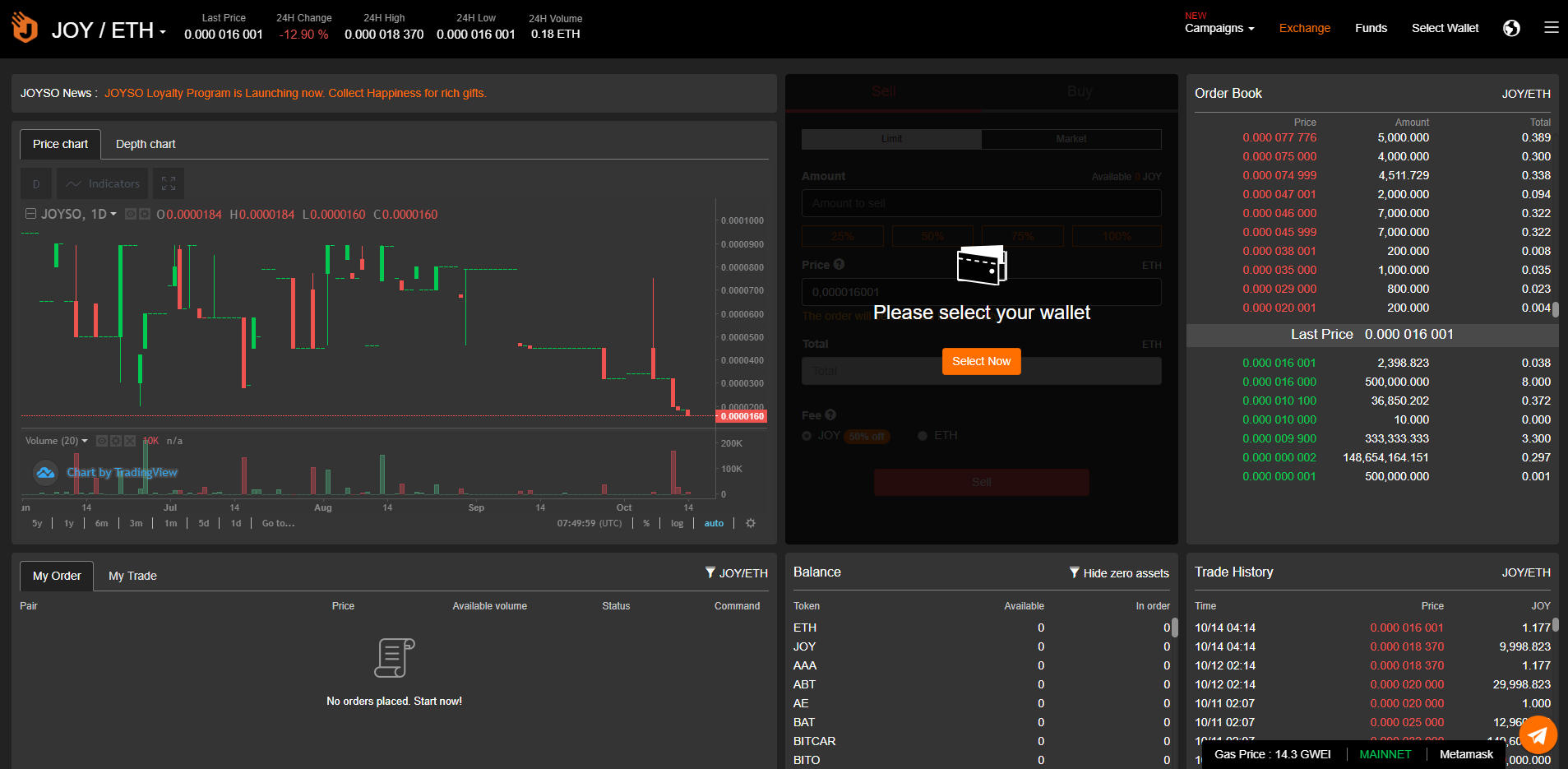

Joyso Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. This is the trading view at Joyso:

Joyso Fees

Joyso Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers are so named because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

Joyso's trading fee for takers is 0.20%. Makers enjoy a discount on the trading fee and they trade with a trading fee of 0.10%. If you pay the fees using JOY-tokens, you receive a discount on the trading fees (50% discount).

These fees are below, or in line with, the industry average which has historically been 0.25% but is now creeping towards 0.10%-0.15%.

Joyso Withdrawal fees

Joyso does not support trading in BTC, so they don’t have a BTC-withdrawal fee that we can compare against other exchanges’ BTC-withdrawal fees. Their ETH-withdraw fee, however, is 0.0006 ETH. This should be compared with other exchanges’ ETH-withdrawal fees in our Exchange List, such as EtherDelta (charging 0.0007 ETH per ETH-withdrawal), Kyber Network (charging network fees, 0.004782 ETH per ETH-withdrawal) and Bilaxy (charging 0.01 ETH per ETH-withdrawal).

In comparison with the above exchanges, Joyso’s withdrawal fees are unmatched – meaning that they are very competitive. Great work, Joyso!

Deposit Methods

This exchange does not accept any other deposit method than cryptos, so new crypto investors are restricted from trading here. If you are a new crypto investor and you wish to start trading at this exchange, you will have to purchase cryptos from another exchange first and then – as a second step – deposit them here. Don’t worry though, you can find a so called “entry-level exchange” simply by using our Exchange Finder tool.

Joyso Security

The servers of DEXs spread out all across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network of servers. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges.