T1Markets

Frais de l'echange

Méthodes de dépôts

Cryptos prises en charge (18)

UPDATE 20 December 2023: We have received reports from a number of independent sources that T1Markets does not process withdrawals and does no longer respond to support queries. On the platform's Trustpilot-page, they have 73 reviews with an average rating of 1.3, with numerous individuals detailing how they have been defrauded or duped.

Accordingly, we have marked T1Markets as a scam in our database and moved it to our Exchange Graveyard.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

T1Markets Review

What is T1Markets?

T1Markets is a trading platform based in Cyprus that has been active since July 2020. It is licensed by the Cypriotic authority CySec and owned by General Capital Brokers (GCB) Ltd.

FX, Precious Metals, Share Indices And More

The platform also operates with other asset types than cryptocurrencies; forex, precious metals, share indices, FX and commodities. The cryptocurrency contracts (also known as CFDs) you purchase are settled by the help of another exchange: Bitfinex. To our understanding, based on information we haver received from T1Markets, there are 18 different crypto CFDs offered by T1Markets.

Silver, Gold and Platinum

There are three different account levels available at T1Markets: Silver, Gold and Platinum. The various levels have different spreads charged, different leverage levels and different available base currencies.

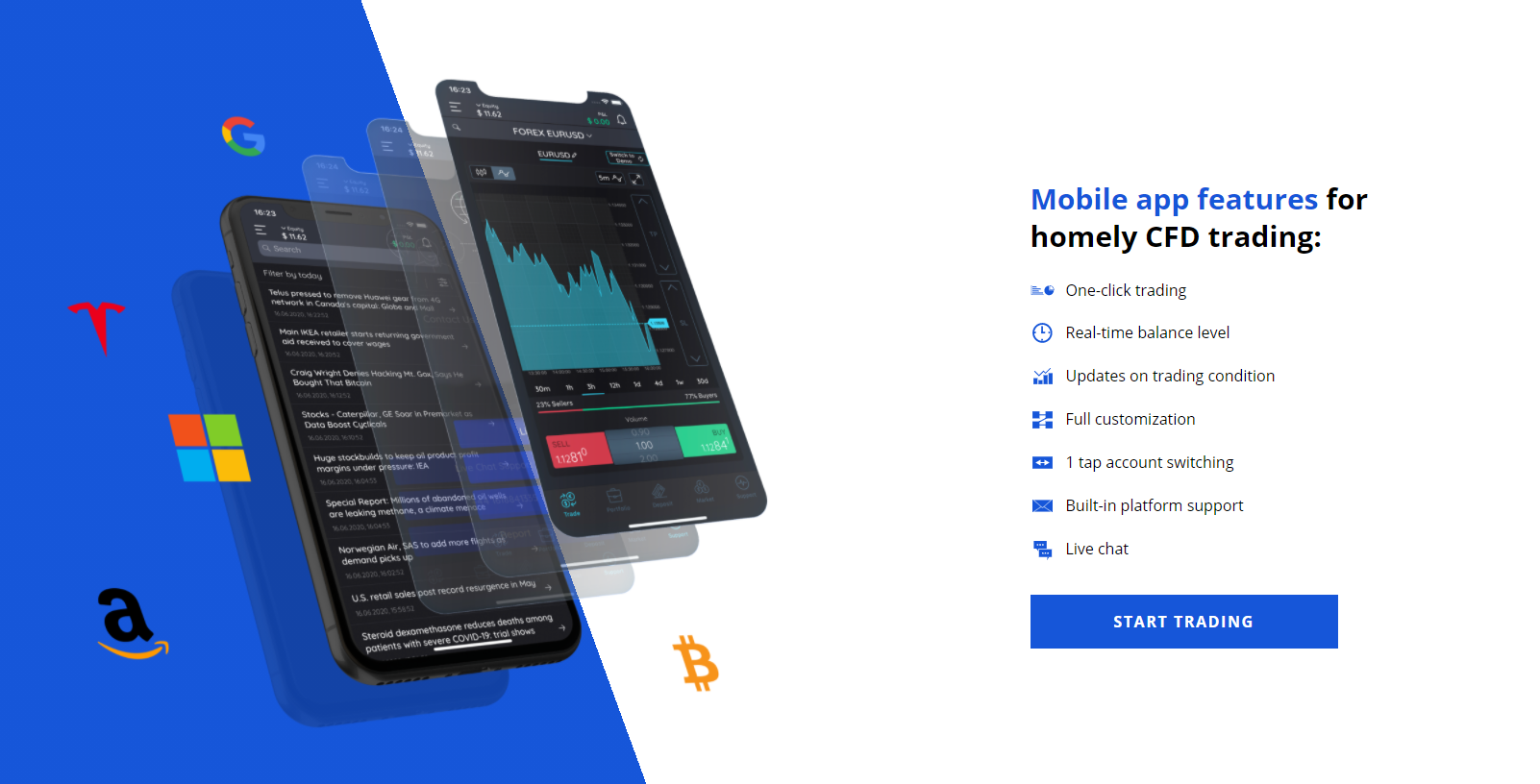

Mobile Support

Most CFD-traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that T1Markets’s trading platform is also available as an app for iPhone and Android users.

T1Markets Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you.

At T1Markets, the trading takes place through either the so called MetaTrader 4 Platform, developed by MetaQuotes Software Corporation, or the WebTrader. The following is the trading view at T1Markets when connecting (with a practice account) to the WebTrader:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Leveraged Trading

T1Markets also offers leveraged trading. Leveraged derivatives trading can lead to massive returns but – on the contrary – also to massive losses. For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, there is potential for huge upside but also for huge downside…

T1Markets Fees

T1Markets Trading fees

To start off with here, it is worth pointing out clearly that you cannot buy crypto from T1Markets. You can only trade crypto CFDs. These CFDs are settled by another exchange (Bitfinex).

On the date of first writing this review (18 March 2021), we compared the buy rate for Bitcoin offered by T1Markets with the market price for Bitcoin according to Coinmarketcap. When doing that comparison, we noticed that the difference between these two rates was approx. 0.30%. Accordingly, we have listed 0.30% as the fee charged by T1Markets in our database.

T1Markets Withdrawal fees

This exchange does not charge any withdrawal fees themselves. However, as always, there are network fees involved when making a transaction. This means that the only fee you need to be concerned with when withdrawing from this platform, is the network fees paid to the miner. This withdrawal fee, or rather lack of withdrawal fee, is below the industry average and very competitive.

Overall, the fee level here is perfectly fine.

Deposit Methods and US-investors

Deposit Methods

T1Markets accepts deposits through both wire transfer and credit cards. Many crypto investors view this as very positive of course. Seeing as T1Markets accepts deposits of fiat currency, the exchange qualifies as a so called “entry-level exchange”, at which new crypto investors can take their first steps into the exciting crypto world. You can however not deposit crypto from another exchange or wallet into your account with T1Markets, seeing as T1Markets only supports CFD Crypto-trading and not actual crypto trading.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

T1Markets does not allow US-investors on its exchange. So if you’re from the US and would like to engage in crypto trading, you will have to look elsewhere. Luckily for you, if you go to the Exchange List and use our exchange filters, you can sort the exchanges based on whether or not they accept US-investors.