XBTS.io

Taxas da Bolsa

Métodos de Depósitos

Criptos Suportadas (48)

XBTS.io Review

What is XBTS.io?

XBTS's offering includes being a multi-chain decentralized exchange and DeFi operating at BitShares blockchain since 2018. XBTS is a Dex for trade, DeFi, staking, exchange, holding cryptocurrencies, Cross-Chain transactions, and an entry point to volumes of decentralized markets.

XBTS themselves state that the platform provides “prompt and comfortable exchange of Bitcoins and Altcoins”, with instant buy and sell of crypto at fair prices with blockchain guarantees. Each trading operation is saved in blockchain. The confirmation time is apparently only 3 seconds.

XBTS.io Advantages

Many exchanges present 3-4 advantages with their respective platforms on their websites. Not XBTS.io. They present nine advantages. Out of these advantages, we would say that low cost trading, high liquidity and the security aspects are the most important ones. But we’ll let you decide for yourself:

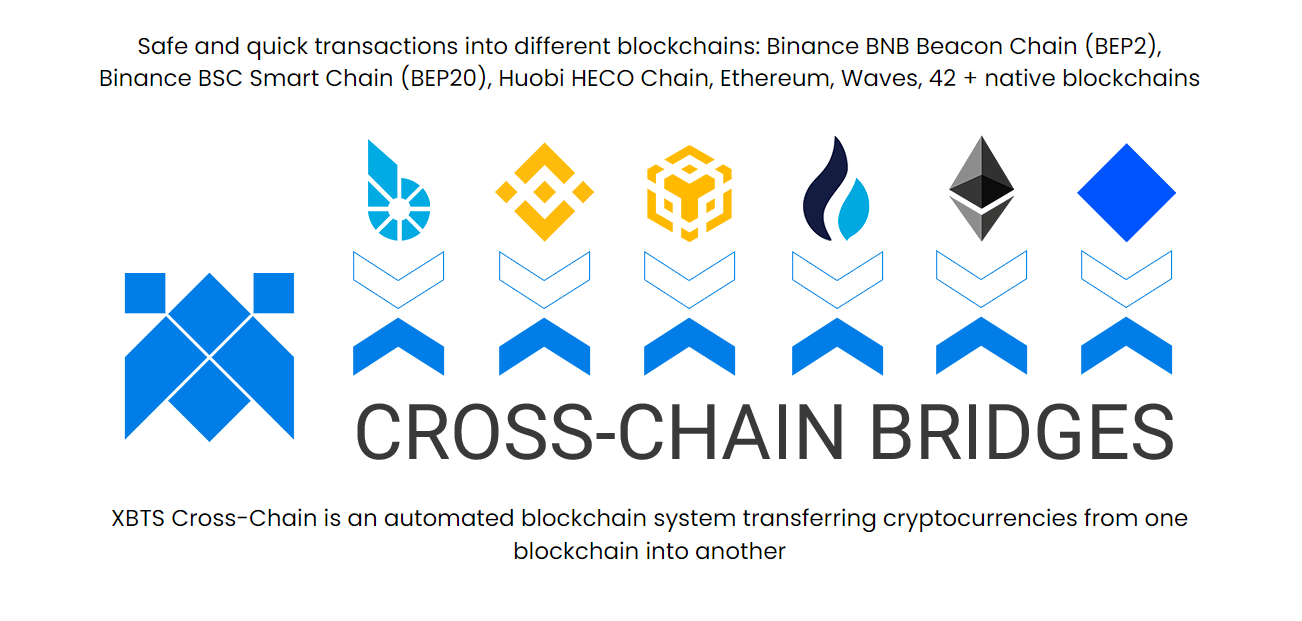

Cross-Chain Bridges

XBTS Cross-Chain bridges is an automated blockchain system with instant transfer to popular trading platforms: Binance BNB Beacon Chain (BEP2), Binance Smart Chain BSC (BEP20), Huobi HECO, Waves, Ethereum, and transfers to 42+ native blockchains. With the fast deposit and withdrawal of assets, Cross-Chain bridges allow traders to implement a number of different strategies.

XBTS.io Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. The below is a picture of the trading view at XBTS.io:

DeFi UI

Integrated Block Explorer

Another service offered by XBTS.io is what they call the Integrated Block Explorer. As you surely know, all of the user's transactions are on the blockchain, so no one can change or delete them. Thanks to the Integrated Block Explorer, users can track not only exchange transactions but also specific events such as airdrops and giveaways.

XBTS.io Fees

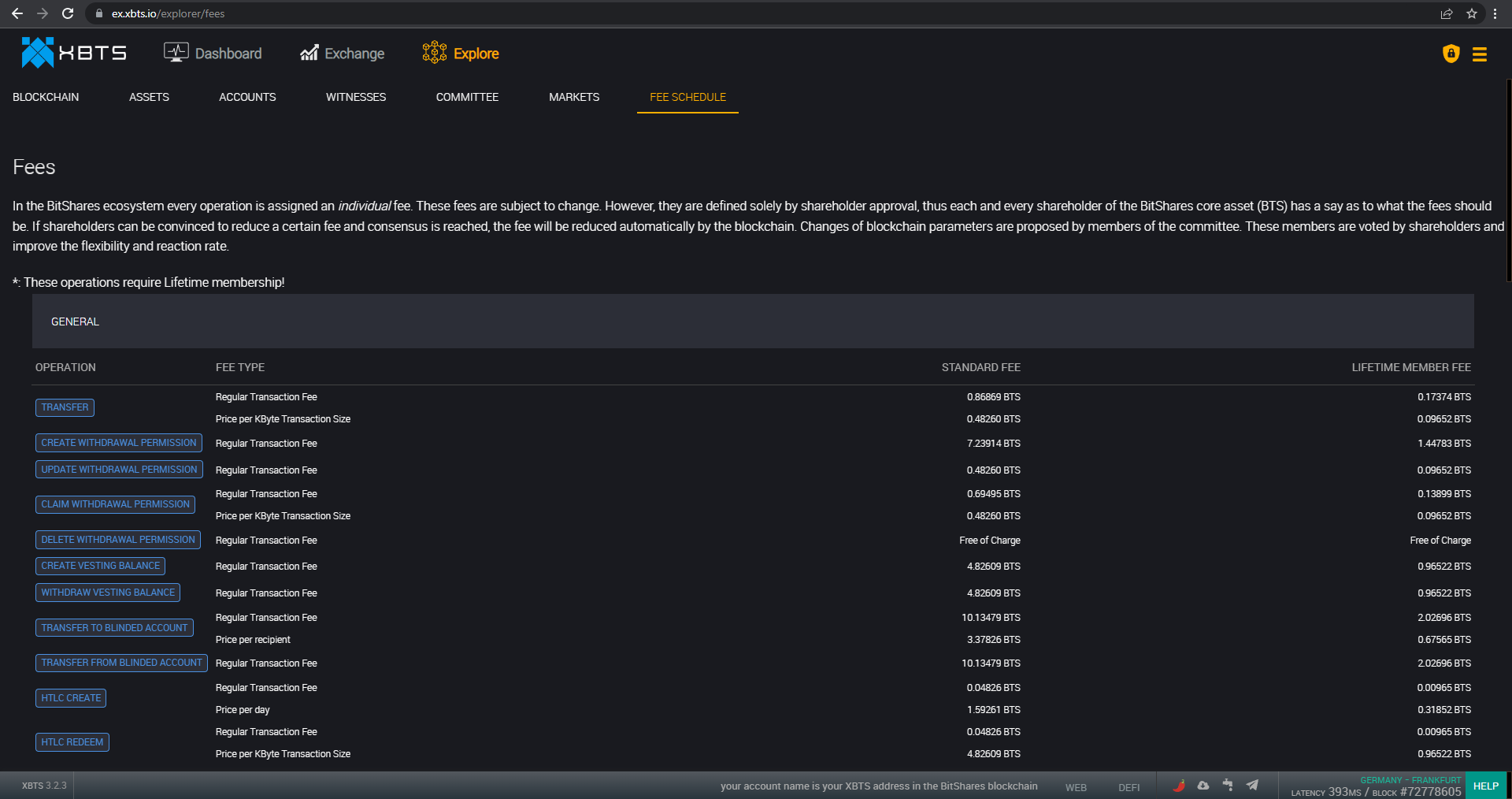

XBTS.io Trading fees

Trading fees are normally set as a percentage of an order value. This means that if you make a trade for USD 1,000, and the trading fee is 0.25%, you would pay the equivalent of USD 2.50 in trading fees. At this exchange, however, trading fees are instead fixed fees payable in Bitshares (BTS) or any other crypto. This is quite different. But overall, the fixed BTS-fees becomes very competitive. The below is a print screen from part of the fee structure at XBTS.io:

XBTS.io Withdrawal fees

The withdrawal fees are also important to consider. Different from the trading fees at most exchanges, withdrawal fees are almost always fixed. Just as the trading fees at XBTS.io.

On the date of last updating this review (28 September 2022), the withdrawal fees were 0.86869 BTS per transaction. On that date, 0.45468 BTS equalled 0.0000005 BTC.

The global industry average BTC-withdrawal fee is 0.0004599 BTC per BTC-transaction. This means that the BTS-withdrawal fee at XBTS.io is more than 100 times lower than the industry average withdrawal fee (for BTC-transactions). However, it should be noted that it is not entirely fair to compare BTS-withdrawals against BTC-withdrawals as different cryptocurrencies have different pressure on their respective networks.

In any event, what we can conclude with certainty is that the withdrawal fees here are not high but rather very competitive.

Deposit Methods

XBTS.io does not accept any deposits of fiat currency. This means that new crypto investors (i.e., investors without any previous crypto holdings) can’t trade here. In order to purchase your first cryptos, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency.

XBTS.io Security

The servers of DEXs normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime. It also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A hacker can therefore hack a centralized exchange and steal your funds held at such exchange. This is not the case with respect to decentralized exchanges.