ZT.com Exchange

Taxas da Bolsa

Métodos de Depósitos

Criptos Suportadas (88)

UPDATE 18 September 2024: When trying to access the website of zt.com today, we were unsuccessful. As far as we know, there have been no preceding messages on system maintenance or new websites or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

ZT.com Exchange Review

What is ZT.com Exchange?

Established in 2018, ZT.com Exchange is a subsidiary of ZT Global and is incorporated in Seychelles. Presently, ZT.com serves users from more than 158 countries. It is a centralized exchange that supports crypto-to-crypto transactions, with support for many altcoins. Users can buy or sell their stablecoins in lieu of fiat currency via its OTC desk.

The portal also sports a ZT Savings section that offers passive income by locking up their crypto tokens for a pre-determined period. In November 2020, ZT Savings launched support for EOS Token, DOT Token and TRX token.

US Investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

ZT.com Exchange does not specifically list down countries where its services are prohibited/restricted. However, it clearly states that in countries where cryptocurrency trading is not approved by the regional laws, users may witness restricted/suspension of services. So if you’re from the US and would like to engage in crypto trading, you may consider ZT.com in accordance with the laws of the land. Luckily for you, if you are looking for other alternatives, you may go to our Exchange List and use our Exchange Filters, you can sort the exchanges based on whether or not they accept US investors.

Mobile Support

Most people do their trading on desktops. However, there is also a significant number of people out there who prefer to do their cryptocurrency investments via mobile. If you’re one of those people, you’ll be happy to know that ZT.com’s mobile apps are available for both Android and iOS. Additionally, it also provides API support.

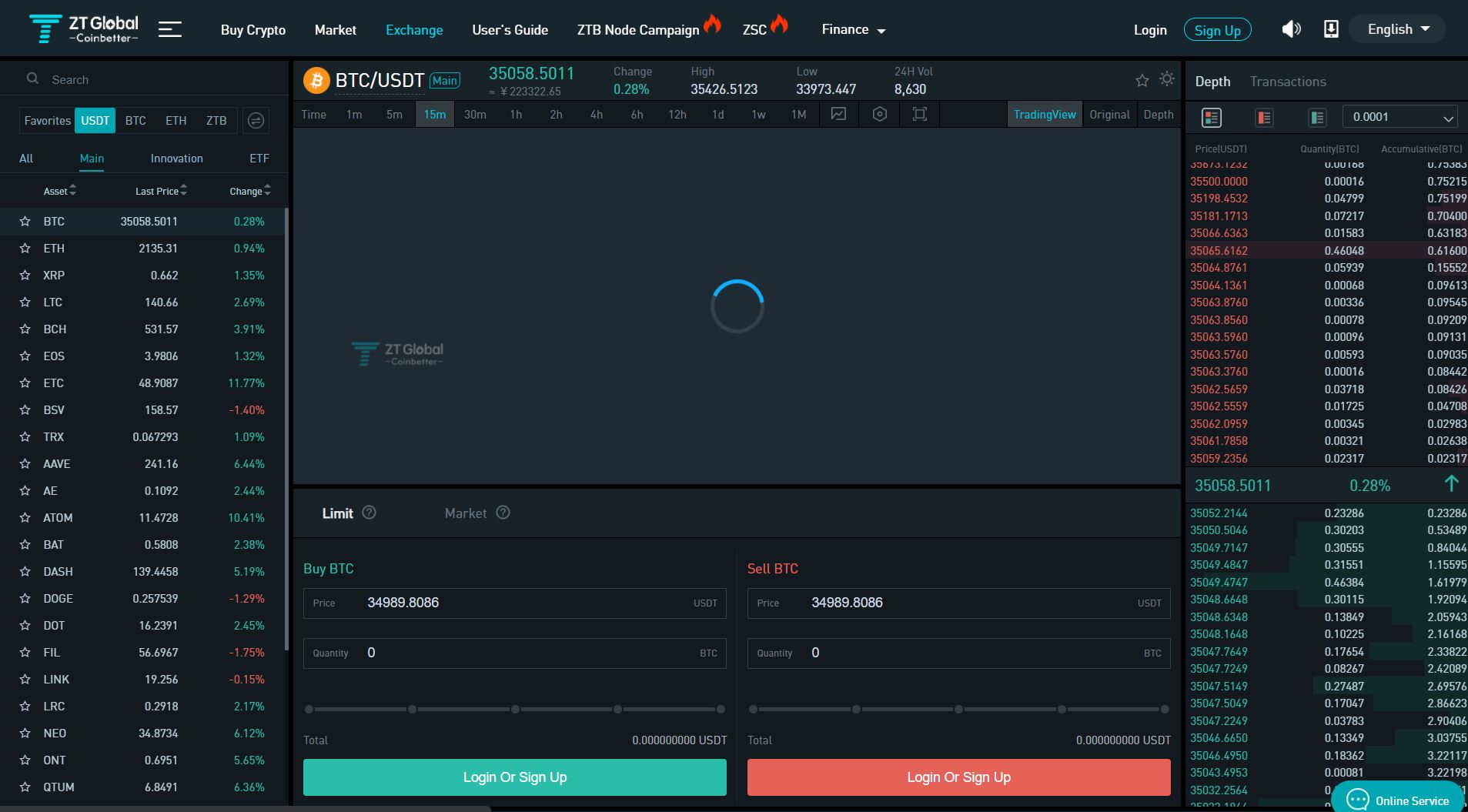

ZT.com Exchange Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at ZT.com Exchange:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

ZT.com Exchange Fees

ZT.com Exchange Trading fees

Many exchanges charge what we call taker fees, from the takers, and what we call maker fees, from the makers. Takers are the people removing liquidity from the order book by accepting already placed orders. Makers are the ones placing those orders. The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

This exchange levies a flat charge of 0.20% for all transactions, excluding assets received.

ZT.com Exchange Withdrawal fees

When withdrawing BTC from ZT.com’s trading platform, you will have to pay 0.0005 BTC. To our knowledge, the only empirical withdrawal fee study that has been made was the one we at Cryptowisser.com made some time back. That study showed that the industry average BTC-withdrawal fee in Q1 2021 was around 0.00059 BTC per BTC-withdrawal. The Q1 2021 average withdrawal fee declined from 0.000643 BTC in the fourth quarter of 2020.

It is evident that ZT.com’s withdrawal fees are lower in comparison to the industry average.

To summarize, both the trading fees and withdrawal fees charged by this platform are very competitive.

Deposit Methods

In order to trade here, you must have some of the supported cryptocurrencies, to begin with. You can deposit any of the major cryptocurrencies supported by the platform. However, if you really prefer ZT.com but you don’t have any of the major supported cryptos yet, you can easily use its OTC module to buy cryptocurrencies. ZT.com supports multiple payments methods like bank cards, Alipay and WeChat.

Use our Exchange Filters to easily see which platforms that allow wire transfer or credit card deposits.