The Best Crypto Cashback Cards January, 2026

Bitcoin debit cards provide perks like cash-back rewards in return for customers making purchases using their digital assets.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

| Characteristics | Funding Methods | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Cryptos | Card Type | Spending Fee | Cashback | Wire | Credit | Paypal | US Allowed | Offer | |

| 129 | 0.00% | 1.00% - 8.00% |

GET UP TO 5% CASHBACK ON YOUR PURCHASES!

|

Visit | ||||||

| 8 | 0.20 USD | 2.00 - 22.00% |

|

|||||||

| 8 | 0.00% | 2.00 - 20.00% |

|

|||||||

| 344 | 0.90%-2.00% | 0.10% - 8.00% |

|

|||||||

| 117 | 2.69% | 4.00% |

SPEND CRYPTO ANYWHERE!

|

|||||||

Bitcoin debit cards provide perks like cash-back rewards in return for customers making purchases using their digital assets. They also support multiple cryptos, including prominent currencies such as Bitcoin, Ethereum, and Polkadot. Strong security standards support Bitcoin debit cards to safeguard your money.

Key Takeaways

- Crypto credit cards used for everyday purchases often give cashback rewards ranging from 1-8% per transaction.

- Crypto.com offers customers the best overall cashback card for US customers.

- The Club Swan card is FCA regulated.

- The Wirex card offers the best overall cashback rewards.

How Does Crypto Cashback Work?

Crypto firms that offer credit cards or debit cards require the user to open an account, certify who they are, and then put in the necessary amount of native tokens or other cryptos to register the account. Following that, they will receive the debit or credit card without cost.

Many cards operate with a software crypto wallet and application, allowing users to load fiat and cryptocurrency on the card, make payments and manage funds via mobile device. After loading funds, you can use the card like any traditional debit or credit card with merchants, vendors, or ATMs.

Where Can I Use Crypto Cards?

Cardholders who own Bitcoin can receive a debit card provided by large credit card companies (generally Visa or MasterCard) that can be used online or at stores where credit cards are accepted. This means that crypto cards can typically be used everywhere.

It is worth noting that Bitcoin debit cards are mostly accessible to people living in specific areas, normally Europe and the US—though we are now seeing more companies operating further afield, such as in Latin America.

How Do Crypto Cashback Cards Work?

Crypto debit cards, or as they are sometimes known, Bitcoin debit cards, work just like prepaid debit cards, which can be loaded with cryptocurrency allowing you to make digital and in-store purchases from places that don't accept cryptocurrencies.

Through these cards, stored Bitcoins or other digital currencies can be converted into any form of fiat money required to complete a transaction. Furthermore, Bitcoin debit cards permit users to take out currency from ATMs in whatever fiat is natively supported by the card.

Crypto credit cards have numerous advantages over their traditional counterparts; these benefits include the following:

- Huge value in rewards for purchasing. Only a few traditional credit cards offer a point system, but then to a much lower level than what crypto credit cards offer.

- Flat rate rewards paid out in Bitcoin (among other currencies) starting at 1.50%.

- Tiered rewards system depending on the type of purchase made (groceries, meals, e-commerce, etc..)

- Easy to convert crypto into spendable money.

- Avoid crypto withdrawal fees charged by exchanges.

Prominent Crypto Cashback Cards

Our in-house crypto experts have compiled a list of the best providers for readers curious about cards that reward customers with cashback for Crypto payments. We've got a shortlist for those who don’t have time for the long read. There is no ranking involved here. Below you’ll find four of the best suppliers for earning rewards while making crypto transactions:

- HODL Card - HODL Card is issued by Club Swan and is intended to be used by both new crypto investors and globetrotters, as it's accepted in over 120 countries.

- Coinbase Card - Coinbase offers a Visa card compatible with Apple Pay, offering up to 4% cash back on every purchase.

- Revolut Metal Card - Revolut offers a Mastercard supporting major currencies such as Bitcoin, Ethereum, and Litecoin and access to the Euro.

- Binance Card - The card was first released in 2020 and is authorized by the Financial Conduct Authority to issue e-money. The card is widely available across Europe.

We'll review three unique cards that stand out from the rest for anyone looking for a more in-depth look at certain crypto cashback cards.

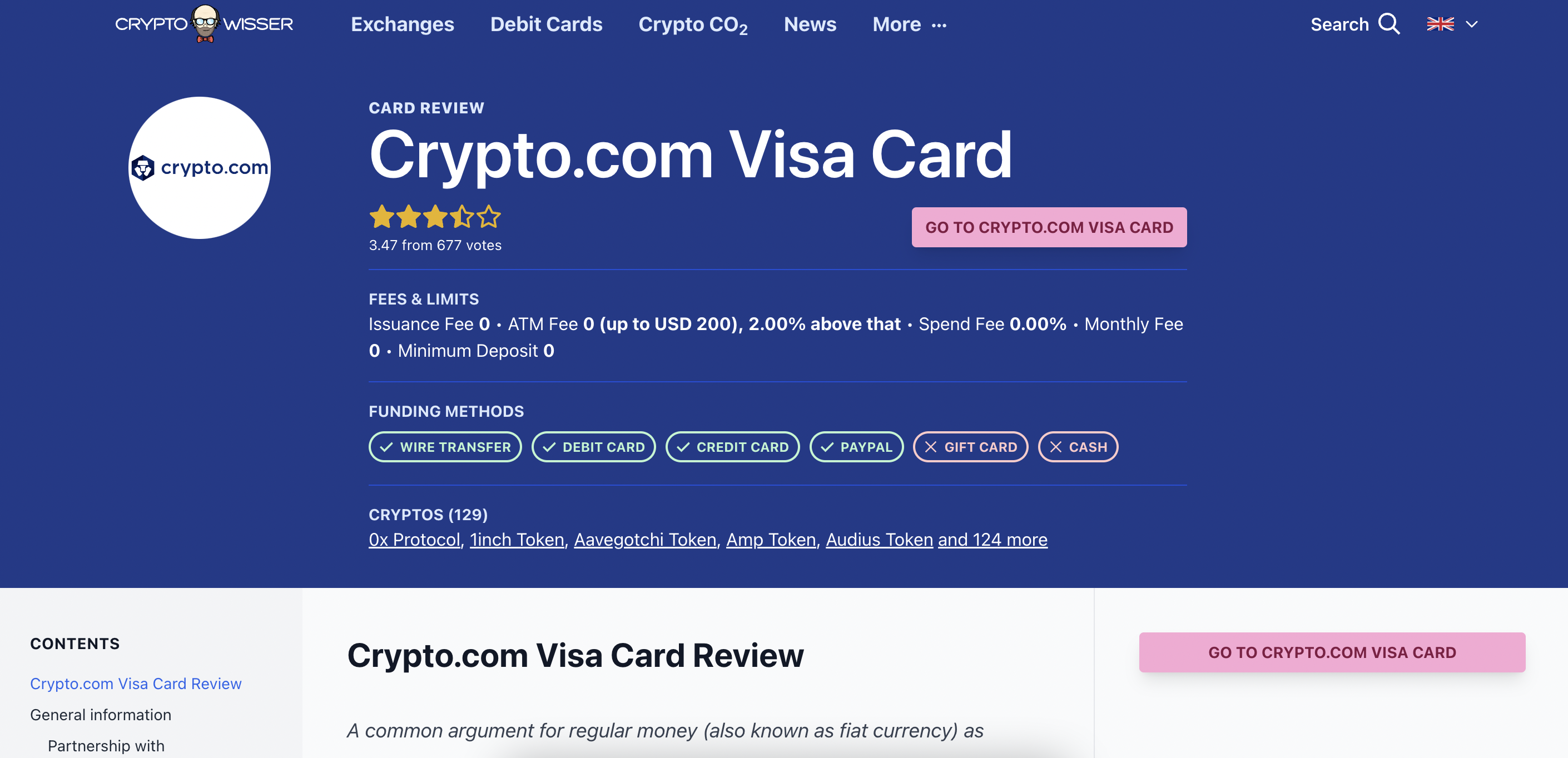

Best Overall Cashback Card For US Citizens: Crypto.com

Crypto.com has the best selection of cryptocurrencies supported because they offer seven diverse metal Visa debit cards that let people spend with over 80+ cryptocurrencies and 20+ fiat currencies anywhere a Visa card is accepted.

To acquire the Crypto.com cards, cardholders must put down some CRO tokens (previously MCO) held by the company. The cost for each CRO token is currently $0.06. The level of CRO-tokens you need to stake to be eligible for the different Crypto.com cards ranges from 0 CRO up to 6,000,000 CRO (today corresponding to approx. $400,000).

The Crypto.com Ruby Steel card is their most sought-after and reasonable offering, requiring users to stake just $400 of CRO. With this card, you get 1.00% back on each purchase and a total reimbursement for one yearly Spotify subscription, and you won't be charged anything for withdrawing up to $400 monthly from ATMs.

For those not wishing to invest $400 for a Visa card, Crypto.com's Midnight Blue card grants no ATM fees for withdrawals up to $200 monthly. Additionally, their other cards showcase 0.00-5.00% rebates on certain streaming services and no ATM withdrawal fees.

Pros and Cons

Pros |

Cons |

| Support over 80 cryptocurrencies. | You must purchase - and stake - Crypto.com's native token CRO to use the card. |

| No initial payments on issuance or monthely fees for holders | To access the best perks, users must stake CRO. |

| Enjoy rebates for major streaming services, including Spotify, Netflix, Expedia, Airbnb, and Amazon Prime |

Best Cashback Card For International Clients: Club Swan

The Club Swan Mastercard is a subscription-based debit card that allows consumers to spend various fiat currencies, such as GBP, USD, and EUR. With a Mastercard debit card, you can turn your cryptocurrency into fiat currency and use it to make purchases. Various membership tiers are available; the more expensive tiers provide more benefits. If you opt for the least pricey tier, it will cost $550 for the first year.

One of the major advantages of being a Club Swan card member is access to all-day and night concierge services. These services offer extravagant benefits and amenities to customers. Members at higher levels of membership can take advantage of exclusive VIP services, including their hotline. With the Club Swan card, you will earn cashback rewards based on your card level.

The Club Swan card may only be suitable for some due to the expense. The base membership fee is $550 for the initial year. After that, there is a yearly cost of $420 with no joining fee. Whenever one changes their crypto into fiat or inversely, it calls for a 3% per transaction payment which is six times higher than a typical crypto exchange fee (0.5%). However, anyone using the Club Swan card will have to expect the fees attached due to the benefits and quality of the perks customers receive.

Pros and Cons

Pros |

Cons |

| Regulated by the Financial Conduct Authority (FCA). | Membership fee as well as a monthly subscription fee. |

| Concierge services for travel, accommodations, and hotels. | Relatively high fees for converting fiat to crypto. |

| Unique metallic cards. |

Best Cashback Card For Perks: Wirex

In 2014, Wirex was established as a digital payments platform and released a Visa-supported cryptocurrency debit card one year later. This card stands out among others due to its rewards offered in WXT, making it our top choice for the best cardholder perks.

Cardholders that use the Wirex card are not subjected to issuance, monthly, or withdrawal fees. Additionally, it supports over 150 conventional and fiat currencies and a few fiat currencies across Europe, Asia Pacific nations, and the United States.

One strong offering of the Wirex card is that it provides up to 8% cash back on purchases in cryptocurrency. Standard delivery for this card has no charges, and there are no costs for revisions or upkeep. Wirex Visa allows free withdrawals from ATMs to a limit of around $400 monthly. Wirex has also incorporated a new characteristic, X-Accounts, allowing customers to get up to 16.00% interest on fiat and 10% on BTC and ETH.

Pros and Cons

Pros |

Cons |

| Supports a range of currencies, including 150+ traditional and fiat options. | High fees for exchanging between crypto and fiat. |

| Excellent rate on cashback and referral bonuses. | Users must have a balance of Wirex native tokens to earn rewards. |

| No monthly rates or issuance fees. |

The Future of Crypto Credit Cards

As crypto continues evolving, cryptocurrency credit cards will likely become more relevant. Most crypto cards have only been accessible for a few years, showing that there is still an abundance of space for development down the line.

Provided cryptocurrency markets keep increasing in demand, the benefits of using digital currency in our daily expenditure will be hard to ignore. While many users aren’t spending their digital assets due to the continued market slump, crypto cards will become more prevalent as the market stabilizes and adoption grows.

Given the difficulties the market faced in 2022, we are unlikely to see crypto firms pushing crypto credit cards to clients as they will be primarily focused on surviving, as we’ve seen with the collapse of various crypto companies in the last 12 months. However, once the market climbs, we can expect a resurgence from crypto cards and firms encouraging holders to interact with their digital assets beyond holding.

To Sum It Up

With a wealth of options, finding the right card to suit your needs can take time. There are numerous options available if you're searching for a credit card with good cashback rewards, the ability to handle multiple currencies, or low fees. With both Visa and Mastercard options, customers can choose many versatile and flexible crypto cashback cards.

We have highlighted some of the best providers operating today, as well as going into more detail about three of the best for customers with specific spending desires; Crypto.com and Wirex cards. All the options mentioned above are reliable and backed with robust security features, allowing you to complete purchases in physical stores and online.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!

| Characteristics | Funding Methods | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Cryptos | Card Type | Spending Fee | Cashback | Wire | Credit | Paypal | US Allowed | Offer | |

| 129 | 0.00% | 1.00% - 8.00% |

GET UP TO 5% CASHBACK ON YOUR PURCHASES!

|

Visit | ||||||

| 8 | 0.20 USD | 2.00 - 22.00% |

|

|||||||

| 8 | 0.00% | 2.00 - 20.00% |

|

|||||||

| 344 | 0.90%-2.00% | 0.10% - 8.00% |

|

|||||||

| 117 | 2.69% | 4.00% |

SPEND CRYPTO ANYWHERE!

|

|||||||