Binance.US vs Coinbase: Find The Best Exchange For US Traders March, 2025

To invest in cryptocurrency, you must know where to buy digital assets like Bitcoin, Ethereum, or a smaller-cap altcoin. Many platforms can help you do this, but Binance.US and Coinbase are the most widely used and popular crypto exchanges worldwide

Written by Nikolas Sargeant

Written by Nikolas Sargeant

| Комиссии биржи | Методы внесения депозита | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Названия | Поддерживаемые криптовалюты | Комиссия тейкера | Комиссия мейкера | Комиссии за вывод средств | Банковский перевод | Кредитная карта | США | АКТИВНЫЙ С | Offer | |

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Посетить | |||

Binance.US

Centralized Exchanges

|

145 | 0.60% | 0.40% | 0.0002 | 2019 |

ZERO TRADING FEES ON BTC-TRADES

|

||||

Coinbase Pro

Centralized Exchanges

|

116 | 0.60% | 0.40% | 0 | 2018 |

|

||||

To invest in cryptocurrency, you must know where to buy digital assets like Bitcoin, Ethereum, or a smaller-cap altcoin. Many platforms can help you do this, but Binance.US and Coinbase are the most widely used and popular crypto exchanges worldwide.

When investing in the crypto market, choosing the right exchange is crucial. This is especially important for beginners who may be discouraged by a poor experience or lack of accessibility. Take the time to find a suitable exchange to ensure a smooth trading process.

Regarding choosing a cryptocurrency exchange as a US citizen, Binance.US and Coinbase are two very popular options. However, the best choice depends on your specific needs, such as which coins you want to trade and what you are willing to be charged in trading fees.

To help traders make informed decisions, we put together a comparison between Binance.US and Coinbase. We'll look at some of the most important factors to traders and see how they stack against each other.

TLDR:

-

Binance.US offers a far superior range of trading products supported by considerably lower trading fees.

-

Binance.US offers a far broader trading experience, catering to the needs of all kinds of users.

-

Coinbase caters to newcomer traders with a simplistic trading platform. However, the Coinbase platform has substantially higher trading fees, so the easy-to-use part comes at a price.

-

Binance.US features desired crypto trading features such as staking, crypto loans, and some of the lowest trading fees from top-tier exchanges.

Binance.US vs Coinbase - Pros and Cons

For anyone who wants the skinny on these exchanges and doesn’t have time to delve deep into the finer details, we view each exchange's main pros and cons.

Binance.US

Binance.US Pros

-

Multiple versions cater to different proficiency levels and comfort in using cryptocurrency.

-

Boasts one of the lowest fee structures in the crypto space.

-

Offers trading in over 120 cryptocurrencies and tokens.

Binance.US Cons

-

Not available in various U.S. states, including Hawaii and New York.

-

Security was tested back in 2019 when Binance was hacked.

Coinbase

Coinbase Pros

-

Beginner-friendly fundamentals and products.

-

Offers a range of deposit methods, including Apple Pay, and Google Pay, as well as more traditional payment methods.

-

Users will have access to over 170 support cryptocurrencies.

-

Available in all US states and over 100 countries around the world.

Coinbase Cons

-

Without subscribing to Coinbase Pro, fees are particularly high.

-

From 188 customer reviews on Cryptowisser.com, customers were fairly dissatisfied, with a 3.18 rating.

-

The tiered fee structure needs to be clarified, based on a variable percentage of the transaction, depending on region, product, and payment method. Learn more about Coinbase fees here.

Binance.US vs Coinbase

When choosing a trading platform, there is no one-size-fits-all solution. It ultimately depends on the investor's particular goals. Both Coinbase and Binance.US have pros and cons. Coinbase is known for being beginner-friendly, with an easy-to-use interface. Binance.US, on the other hand, has considerably lower trading fees and is more geared toward advanced traders.

When starting a crypto trading and investment journey, platform choice is crucial. There are several factors to consider before making a decision. But first, let’s look at a summary of these two major crypto firms.

| Binance.US | Coinbase | |

|---|---|---|

| Trading Features | A broad range of trading tools, including leveraged trading, derivatives, margins, and futures, among other trading products. | Simple spot trading options with basic analytics. |

| Fees | Buy/sell using bank or wallet - 0.10% / 3% fee on credit card purchases / 25% discounts available when using BNB Coin. | Buy/sell using bank or wallet - 1.49% + 0.50% per trade / 2% fee on credit card purchases. |

| Cryptocurrencies Listed | Over 120 coins and tokens. | Over 170 coins and tokens. |

| Benefits and Features | Access to Binance’s DeFi ecosystem (DEX and Web3 services) and the Binance Academy. | Learn and earn at Coinbase, get industry updates through the News Feed, and receive price alerts to keep you up-to-date. |

| Security | Standard 2FA via SMS or Google Authenticator. All listings go through rigorous whitelisting reviews and partnerships with industry-leading Trust Wallet. | Standard 2FA via SMS or Google Authenticator, coupled with FDIC Insurance, and supported by a native wallet with cold storage. |

| Staking | Up to 6.4% on selected coins. | Up to 5.75% on selected coins. |

| Minimum Order Price | $1 | $2 |

Overview of Binance.US

In 2019, Binance decided to limit its services to U.S. users due to regulatory concerns. As a solution, Changpeng Zhao, the CEO of Binance, launched Binance.US as a separate entity to serve U.S. customers. This was done separately from Binance, the parent exchange.

Binance.US is a platform that provides advanced trading and charting tools for crypto enthusiasts. However, the list of cryptocurrencies on this exchange is more limited than the main Binance exchange. This is due to the fact that it uses securities that aren't registered with the Commodity Futures Trading Commission. Also, Binance.US has a smaller trading volume compared to Binance.

Binance.US is a popular cryptocurrency exchange. It offers spot trading and a range of order types for experienced traders. The firm provides staking, which lets you earn interest on select coins when you hold them. Experienced traders might appreciate Binance.US because it has comparatively low fees. These fees can be further reduced by holding Binance coin (BNB), the exchange's own coin.

Overview of Coinbase

Brian Armstrong, a former Airbnb engineer, and Fred Ehrsam, a former Goldman Sachs trader, founded the first mainstream Bitcoin exchange. It was launched in the United States in June 2012, three years after the Bitcoin white paper gained worldwide recognition.

Coinbase has two platforms: Coinbase and Coinbase Pro. Coinbase Pro is designed for advanced traders and was previously known as GDAX (Global Digital Asset Exchange). The simpler Coinbase platform is ideal for new crypto investors who want to easily buy or convert cryptocurrency.

Coinbase Global made history in April 2021 as the first cryptocurrency company to go public on Nasdaq through a direct listing. The platform has a vast network of approximately 73 million verified users, 10,000 institutions, and 185,000 ecosystem partners across 100 countries. This trust is due to Coinbase's efficient and secure process for investing in cryptocurrencies and using them for exchange.

Coinbase has been successful in complying with regulations. However, the crypto community has criticized Coinbase for collaborating with the IRS and other offices to disclose personal information for taxation.

Binance.US vs Coinbase - Supported Cryptocurrencies

Coinbase and Binance.US both allow users to buy cryptocurrency using fiat currencies like the U.S. dollar, euro, and pound sterling. However, the two platforms differ in their service offerings. One main difference is the number of cryptocurrencies available on each platform.

As two of the leading cryptocurrency trading platforms available to US digital currency enthusiasts, the number of tokens listed constantly updates. But, at the time of publishing, the following number of cryptos were listed on the platforms:

-

Binance.US lists 120 types of digital assets.

-

Coinbase lists 170 types of digital assets.

Using Coinbase is an easy way for users to purchase, hold, or trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Polygon (MATIC), and Ripple (XRP). Whether you're new to crypto or experienced, Coinbase is a popular choice for both types of traders.

Both new and seasoned crypto traders may prefer Binance.US due to its wider range of trading options for smaller cryptocurrencies. Coinbase has a minimum order of $2, while Binance.US offers a superior deal and allows trades for as little as $1.

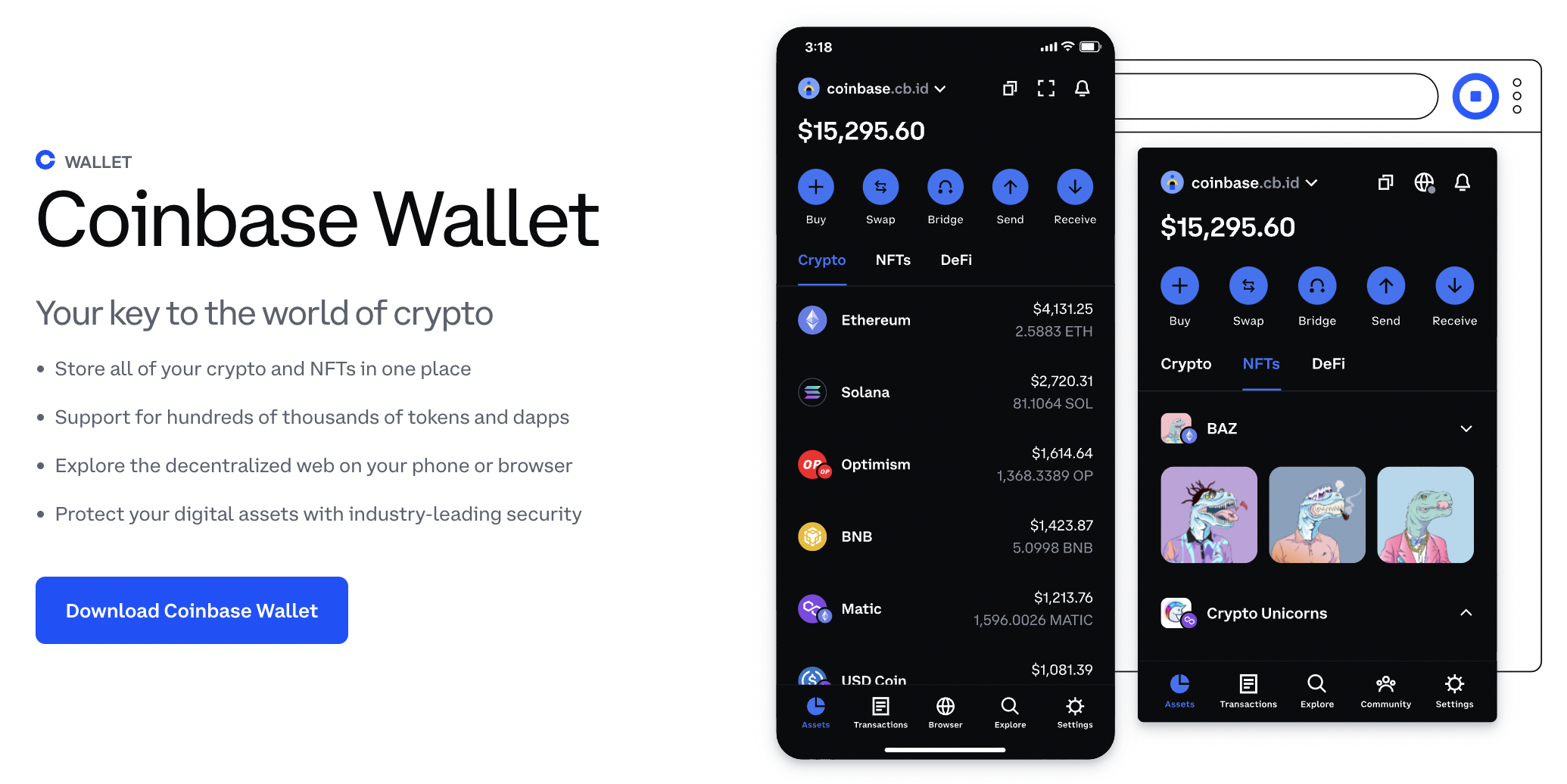

Binance.US vs Coinbase - Wallets

Beginners and advanced users alike should avoid leaving crypto assets on exchanges. Single-server platforms are at a higher risk for hacking attacks than distributed systems. It is important to note this vulnerability when considering where to store crypto assets.

Cryptocurrency wallets come in different types, with hot wallets being internet-connected and vulnerable to hacking attacks. Cold wallets, on the other hand, provide offline storage. Users must choose the best asset protection, especially when using internet-connected wallets.

Crypto exchange wallets are custodial, meaning the exchange is responsible for its customers' assets. This can be risky if the exchange goes bankrupt or suddenly closes, as has happened before. For example, last year, the American earning platform and exchange BlockFi went bankrupt after the whole debacle with FTX.

Custodial wallets work like banks, so users don't have full control of their crypto assets. This means they need the private keys to claim complete ownership. Moving assets out of a custodial wallet requires owners to take responsibility for their assets. If the owners lose the private keys, they may lose access to their funds.

Both Coinbase and Binance.US offer standalone crypto wallet apps and web versions. Binance acquired Trust Wallet in 2018, and it has since become the official Binance wallet. The Trust Wallet supports over 53 blockchains and over 1 million digital assets, including DApps and NFTs.

Trust Wallet has over five million users. It secures assets with a PIN, biometric access, an encrypted key, and a 12-word recovery phrase. Cryptocurrencies stored in Trust Wallet can earn interest and be staked, giving currency holders decision-making power on the network and generating income.

With Coinbase Wallet, storing over 4,000 crypto assets, such as cryptocurrencies, NFTs, and DApps, in one place is possible. This can be done on a mobile device or through a browser. It is designed to provide industry-leading security measures to protect digital assets.

The wallet secures assets with a password and biometric access controls. Additionally, it offers an encrypted 12-word recovery phrase for extra protection. The Coinbase wallet is user-friendly, while the Binance Trust Wallet has lower fees but is less intuitive.

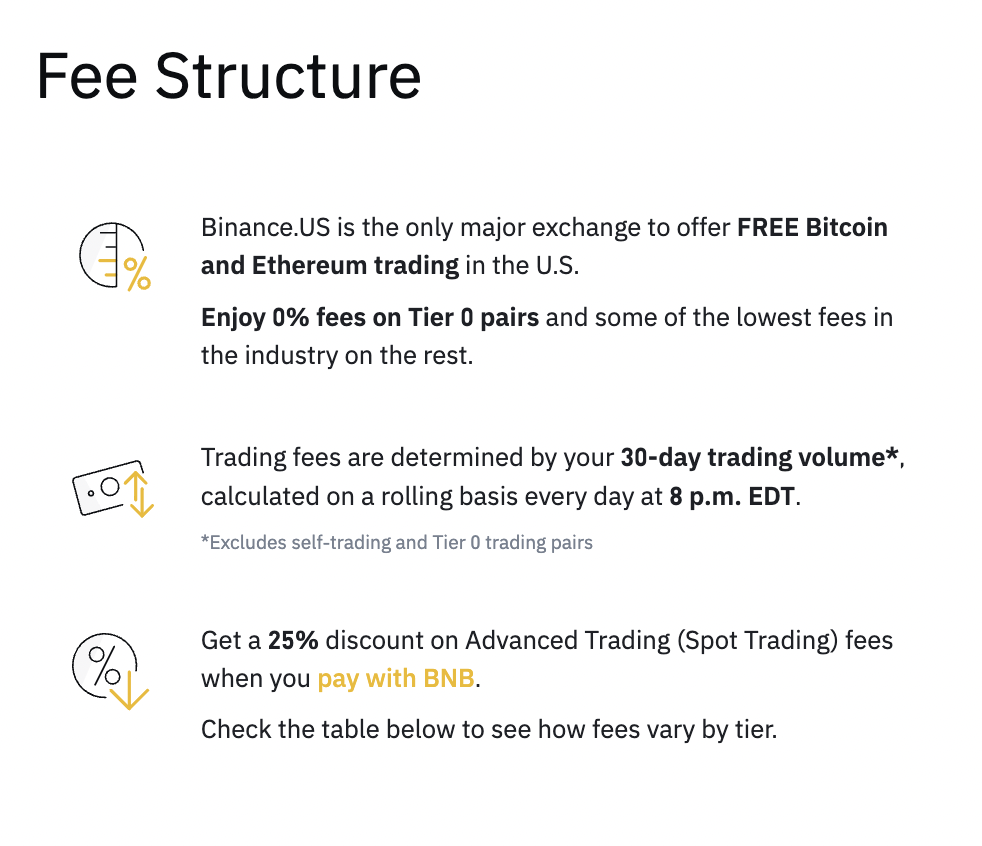

Binance.US vs Coinbase - Fee Structure

The fee structure sets Binance.US and Coinbase apart. Traders and investors take note of crypto exchange fees, especially for deposits and withdrawals. Binance has its token, BNB, which allows for lower fees than Coinbase.

Binance.US

Fiat currency bank transfers are free on Binance.US. You will incur a fee of 4.5% when you purchase cryptocurrencies using a credit card. You can deposit cryptocurrencies for free, but withdrawals depend on the blockchain network and can vary due to network congestion.

Using BNB for trades gives a 25% discount to traders carrying out spot trades. The trading fee for makers and takers is usually between 0%-0.1%.

Coinbase

Coinbase offers free bank transfers but charges a 2% maker-taker fee for traders. If you're buying or selling cryptocurrency on Coinbase, be aware of the fees. Coinbase charges either a flat fee or a percentage fee, whichever is higher. The typical percentage fee is 1.49%.Converting and withdrawing crypto to cash incurs a 1% fee in addition to standard network fees. These fees are necessary to process the transaction on the blockchain network.

Purchasing with a credit card incurs a 3.99% fee. For Coinbase wallet or bank account purchases, a 1.49% fee applies. Wire transfers have a $10 deposit fee and a $25 withdrawal fee. Binance.US offers lower fees per transaction, with a fee structure that appeals to high-volume traders.

Binance.US vs Coinbase - Features

Binance.US and Coinbase make it easy for users to trade cryptocurrency, but they have distinct approaches. Let's look at some of the unique features of each platform.

Binance.US Features

To encourage user involvement on its platform, Binance.US offers giveaways and challenges. These prizes can be redeemed in the Binance.US rewards center. Binance.US also conducts crypto airdrops for currencies that will soon be added to their platform.

Binance Academy is a free education platform that provides a variety of crypto lessons, from beginner to advanced trading tutorials. It's a single source for all things crypto-related. The exchange offers numerous trade types, such as Limit Order, Market Order, Stop Limit Order, Margin Trading, Pool Liquidity, and Peer-to-Peer Trading.

At Binance.US, users can access advanced charting views with numerous overlays and indicators through TradingView charts. Additionally, Binance.US provides public access to its API keys, enabling third-party apps to integrate with its platform.

Coinbase Features

Coinbase provides educational videos on various cryptocurrency projects accessible through their platform and mobile app. Users who watch these videos can earn a small amount of free cryptocurrency as a reward.

The platform has a newsfeed that keeps users up-to-date on crypto news and developments. The feed collects articles from the web to provide crucial changes and trends in the cryptocurrency market.

The firm enables users to set up alerts about price changes in whichever cryptocurrencies they want to track. Using a watchlist of currencies, users can either view updates on the app or get notifications pushed to their mobile phones.

Binance.US vs Coinbase - Security

To safeguard your digital assets, Binance.US and Coinbase provide strong security settings. These platforms offer various security options you can choose from, such as two-factor authentication, email alerts, and withdrawal address whitelisting.

Binance.US Security

Verification Process: Advanced verification is necessary to access more features on the Binance.US platform, such as larger deposit and withdrawal limits. This verification process also helps prevent others from creating a fake account using your identity. The steps to complete advanced verification include uploading a government-issued photo ID and a picture of yourself.

Whitelisting: Binance.US provides address whitelisting, a feature that limits access to addresses that can withdraw your cryptocurrency. Your selected addresses are stored in your address book to prevent unauthorized access to your funds. Additionally, Binance.US offers two-factor authentication (2FA) through SMS or the Google Authenticator app.

Device management: You can check all the devices that have accessed your Binance.US account and block any that you are not familiar with. This feature helps you maintain the security of your account by preventing unauthorized access.

Partnership Trust Wallet: Binance.US does not have a digital wallet. Instead, it partners with Trust Wallet, which has over five million users and is a leader in the digital wallet space. Trust Wallet secures your assets using multiple methods such as a PIN, biometric access, encrypted key, and a 12-word recovery phrase.

Coinbase Security

Cold Storage: Coinbase stores your assets in “cold storage” to protect them from online thieves. They keep 98% of all crypto balances in cold storage. Coinbase also has a cryptocurrency vault to secure your stored digital assets. Vaults prevent fraudulent withdrawals and require multiple user approvals before funds are withdrawn. If all approvals for the transaction are not completed within 24 hours, the withdrawal is canceled.

Native Wallet: Coinbase provides a digital wallet to store your cryptocurrency securely. This wallet is password-protected and has biometric access controls. It also features an encrypted 12-word recovery phrase, which safeguards your digital assets like other digital wallets.

FDIC Insurance: If you're looking to deposit USD into an exchange, Coinbase offers FDIC insurance. This insurance is like a bank and can insure up to $250,000 of your deposited USD funds. But, it's important to note that FDIC coverage only applies to the dollars in your account, not any digital assets you hold. Therefore, if your cryptocurrency experiences loss, it will not be covered in the event of failure.

Two-factor authentication: To secure access to your Coinbase account, two-factor authentication is offered. This requires a six-digit passcode that is time-sensitive. You can set up this security measure through SMS or the Google Authenticator app.

Binance.US vs Coinbase - Staking

Bitcoin uses Proof of Work (PoW) for transaction validation, while Ethereum utilizes a combination of Proof of Work and Proof of Stake. Users must stake their coins and become validators to participate in Proof of Stake. Validators are randomly chosen to help maintain the network and are rewarded for contributing to its functionality. Binance.US and Coinbase users can also earn passive income rewards through staking, but it's important to note some key differences before staking your assets.

Binance.US provides locked yields for over 100 coins, such as Solana, Cardano, and Ethereum staking. On the other hand, Coinbase only offers staking for six coins (with an additional coin, Cardano, coming in 2022). Coinbase also supports staking for Algorand, Cosmos, Tezos, Cosmos, and USD coins in addition to Ethereum. Coinbase used to be the only platform offering ETH staking (ETH 2.0), but Binance.US now offers it. However, the addition of ETH staking has yet to garner as much attention for Coinbase as it did in the past.

Binance.US has an advantage that makes staking decisions easier. Coinbase requires payment of commissions from rewards when staking your crypto. Binance.US makes staking completely free and offers a higher APY, making it ideal for those interested in crypto staking.

In Summary

Binance.US is currently the top-rated crypto exchange at Cryptowisser. This position can be attributed to its low trading costs, which are incredibly important to users. Regarding available coins, Binance.US comes out on top or has a slight advantage over Coinbase. The winner depends on what you're looking for in terms of low trading fees, wide selection, or better support. The comparatively high trading fees at Coinbase are particularly offputting, Binance.US is a firm winner in this department.

| Комиссии биржи | Методы внесения депозита | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Названия | Поддерживаемые криптовалюты | Комиссия тейкера | Комиссия мейкера | Комиссии за вывод средств | Банковский перевод | Кредитная карта | США | АКТИВНЫЙ С | Offer | |

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Посетить | |||

Binance.US

Centralized Exchanges

|

145 | 0.60% | 0.40% | 0.0002 | 2019 |

ZERO TRADING FEES ON BTC-TRADES

|

||||

Coinbase Pro

Centralized Exchanges

|

116 | 0.60% | 0.40% | 0 | 2018 |

|

||||