EMX

Comisiones de intercambio

Métodos de depósito

Criptomonedas compatibles (5)

UPDATE 11 November 2021: When trying to access the website of EMX today, we were unsuccessful. There have been no preceding messages on system maintenance or new websites or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

EMX Review

EMX is a cryptocurrency exchange registered in USA. It has been up and running since May 2019.

EMX focuses on derivatives trading. A derivative is an instrument priced based on the value of another asset (normally stocks, bonds, commodities etc). In the cryptocurrency world, derivatives accordingly derive its values from the prices of specific cryptocurrencies. You can engage in derivatives trading connected to the following cryptos here: BTC, USDT, ETH, LINK, XTZ and EMX.

As a few of its advantages with respect to the derivatives trading, EMX lists that they are secure and reliable, that they advanced trading tools and that they have a customer focused offering with 24/7 support and customizable trading interfaces. These are all very important features of any strong crypto exchange in our opinion.

Leveraged Trading

EMX also offers leveraged trading to its users. The maximum leverage level for their crypto contracts is 100x (i.e. onehundred times the relevant amount). They also highlight that they have a diverse range of products you can trade with, and low fees (more on the latter below under EMX Fees).

A word of caution might be useful for someone contemplating leveraged trading. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

EMX Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at EMX:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

EMX Fees

EMX Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the one who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

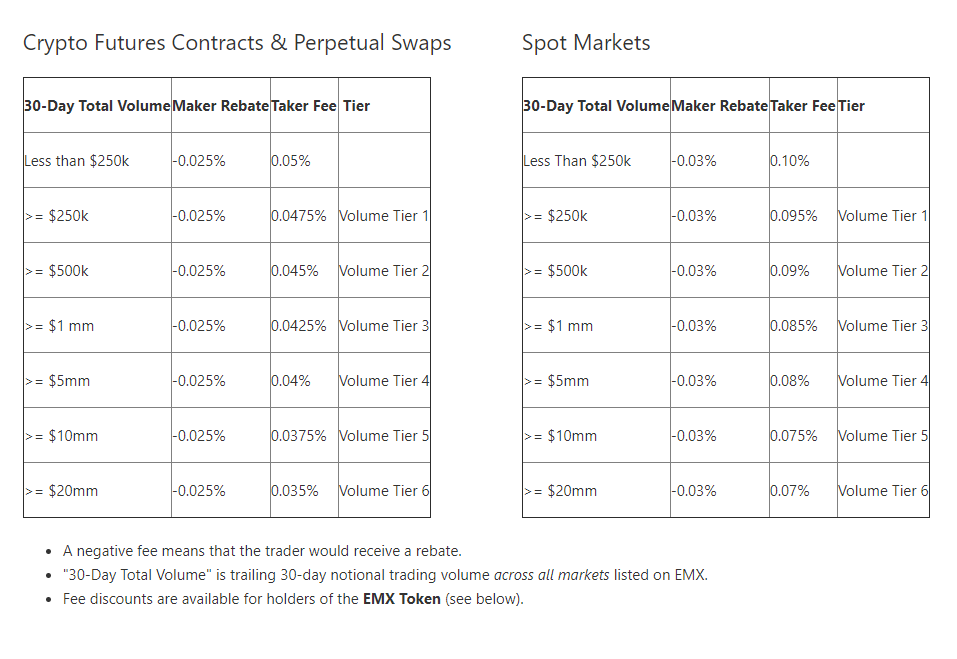

At EMX, takers pay 0.10% (or less). Makers, however, get paid to trade. Their trading fee is thus -0.03%. How does this work then? Well, let's say that you create a sell order for Bitcoin, where you sell a certain amount of Bitcoin for USD 10,000. No matching order is on the order book when you create your order. A buyer then comes along and accepts your order. You were then the maker in this trade (the buyer was the taker). If the maker fee was -0.03%, as it is at EMX, for instance, you would not only get USD 10,000, you would also receive an additional 3.00 USD on top of that.

There aren’t that many exchanges that offer negative maker fees. To see them all and compare them against each other, just check out our Exchange List.

Finally, EMX also offers trading fee discounts to its customers who manage to trade above certain threshholds each month. Here are the available trading fee discounts (futures vs spots):

EMX Withdrawal fees

To our understanding, EMX does not charge any fees of their own when you withdraw crypto from your account at the platform. Accordingly, the only fee you have to think about when withdrawing are the network fees. The network fees are fees paid to the miners of the relevant crypto/blockchain, and not fees paid to the exchange itself. Network fees vary from day to day depending on the network pressure. In general though, only paying the network fees should be considered as below global industry average when it comes to fee levels for crypto withdrawals.

Deposit Methods and US-investors

Deposit Methods

EMX lets you deposit assets to the exchange in many different ways, through wire transfer, debit card, and of course also by just depositing existing cryptocurrency assets.

Seeing as fiat currency deposits are possible at this trading platform, EMX qualifies as an “entry-level exchange”, making an exchange where new crypto investors can start their journey into the exciting crypto world.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

EMX does not allow US-investors on its exchange. So if you’re from the US and would like to engage in crypto trading, you will have to look elsewhere. Luckily for you, if you go to the Exchange List and use our Exchange Filters, you can sort the exchanges based on whether or not they accept US-investors.