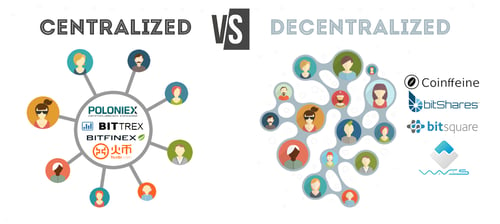

Decentralized exchanges are popping up like mushrooms in the cryptocurrency world. But centralized exchanges still has an iron grip on the majority of all cryptocurrency traders. Which type is the best? Which type will perish? This blog post on Centralized Exchanges vs Decentralized Exchanges sorts out a few advantages and disadvantages with both types.

Background

There are primarily four groups of exchanges:

- Centralized Exchanges;

- Decentralized Exchanges;

- Pure entry-level exchanges; and

- Specialized exchanges.

The distinction is not crystal clear, as centralized exchanges can also have entry-level opportunities, but more on that below.

To begin with, how many cryptocurrency exchanges do you think there are? Is it more than 10? Is it more than 50? More than 100? More than 1,000?

As far as we know, there is no complete record of all exchanges anywhere. But, coinmarketcap.com lists 220 exchanges and – the site that lists more exchanges than any other site in the world – cryptowisser.com, lists more than 350 exchanges, with info on fees, deposit methods, available cryptos, security score etc.

So, if your guess was less than 100, you were wrong.

What are the benefits of centralized exchanges?

Centralized exchanges is the biggest out of the four groups discussed in this article. You might have heard of Binance, Kraken, Bithumb or Bitfinex? These are all centralized exchanges. You might also have heard about a few lesser known ones, such as: VirWox, Coingi, Bitkonan, Triomarkets, Heat Wallet Exchange, Paymium, Bitcoin.de, BTCBank, Xbit Asia, Bitso and Coinvertit?

The centralized exchange category encompasses all of the abovementioned, showing that there’s both “high and low” in this group. From all over the globe.

Liquidity

What about liquidity? An asset’s liquidity is such asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value. This means that if there is only a teeny-weeny difference between the price you can buy something for and the price you can sell it for at an exchange, and sales are executed all the time, the liquidity is great. However, if there are only a few trades a day in a certain asset and there is a big difference between the price someone is willing to buy for and what someone else is willing to sell for, the liquidity is low.

The liquidity at centralized exchanges is normally much better than the liquidity at decentralized exchanges. If you would make a list of exchanges based on their liquidity (in terms of their adjusted trading volume at the date of writing this article), the first decentralized exchange to take place on the list would be Bibox on place no. 11 with a 24 hour trading volume of USD 325 million. That is only 11% of the 24 hour trading volume of the number one on the list, centralized exchange BitMEX.

Liquidity is important for many reasons, one of which being that it makes the exchange less susceptible to market-manipulation. A person trying to manipulate the price of a cryptocurrency by placing fraudulent orders will have a lot more trouble in doing so on an exchange with high liquidity than on an exchange with low liquidity.

Fiat-to-crypto

Many (but not all) centralized exchanges offer fiat-to-crypto trading. This means that you can deposit “real money” to the exchange and then purchase cryptocurrencies with that money. On typical decentralized exchanges, this is not possible. The centralized exchanges where you can start your cryptocurrency trading career by depositing fiat currency, we call “entry-level exchanges”. The following exchanges are the top 5 entry-level exchanges in our Cryptocurrency Exchange List based on user score:

Recovery possible

At centralized exchanges, you can recover your funds from the exchange if you lose your password. If you lose your password, essentially all centralized exchanges have security procedures that make it possible for you to recover your password by just showing your passport copy or provide any other verifying information.

For a decentralized exchange, if you lose your password, you lose all your assets held with such decentralized exchange.

So, if you’re the type of person that tends to forget things and can’t keep track of your passwords, maybe the centralized exchanges are a better alternative to you.

Storage – Advantage or disadvantage?

A centralized exchange stores your assets for you. This is actually the main difference between a centralized exchange and a decentralized exchange. People do argue however about whether it’s an advantage or a disadvantage. Sure, it makes the process of trading a bit easier. But on the other hand, it also brings a higher risk of you losing your assets you have stored with the exchange.

Let’s say you deposit fiat currencies (meaning “non-crypto money”) to a centralized exchange, USD 1,000. Before you use those dollars to purchase anything, the exchange stores it for you. And when you have bought Bitcoin or another cryptocurrency for the dollars, the exchange stores such cryptocurrency for you until you transfer it out from the exchange. This storing aspect makes centralized exchanges – at least in a sense – comparable to banks.

What are the benefits of decentralized exchanges?

The second group of exchanges are decentralized exchanges. A decentralized exchange (or a “DEX”, for short), do not store funds for its users. Rather, deals are made through smart contracts and atomic swaps so that currency never passes through the hands of an escrow service – it’s just peer-to-peer.

There are 20 something bigger decentralized exchanges out there today and the list includes: EtherDelta, Bibox, BitShares Asset Exchange, Waves DEX, Bancor Network, OpenLedger DEX, Stellar DEX, IDEX, Token Store, Bisq, Nxt Asset Exchange, Counterparty DEX, Burst Asset Exchange, OmniDEX, CryptoDerivatives, AirSwap.io, Fcoin Exchange, BarterDEX, Switcheo Network, DEx.top, DDEX and Ethermium (and the upcoming Uniswap).

The four decentralized exchanges with the highest user score in our Cryptocurrency Exchange List are currently:

More in line with Satoshi Nakamoto’s vision

Many people argue that centralized exchanges are in contrast to what Satoshi Nakamoto (credited as the creator of Bitcoin) wanted to achieve. Part of Satoshi’s vision was namely to achieve a society where we can send and receive money without any third party (like a big bank) in between. Centralized exchanges are – like big banks – a third party in between.

This – that decentralized exchanges are more in line with Satoshi Nakamoto’s and the anarcho-capitalist’s vision of a trustless peer-to-peer system – has fuelled the growth of decentralized exchanges.

Impossible to hack

The servers of decentralized exchanges are normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that decentralized exchanges are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. In contrast, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

There have been many hacks of centralized exchanges, and we will discuss these in more detail in a future article.

Often Anonymous

Normally, centralized exchanges also require you to give a lot of information when on-boarding as a customer. This is usually to comply with anti-money laundering rules of the country in which the exchange is based. This is not always the case with decentralized exchanges where you can be more anonymous.

Lower fees

Out of all the decentralized exchanges in our Cryptocurrency Exchange List with clear stipulated taker fees (18 exchanges), the average taker fee is 0,165%. This is almost 50% lower than the average taker fees for centralized exchanges.

Accordingly, decentralized exchanges generally charge lower fees than centralized exchanges. This is doubtlessly a great advantage.

Pure fiat-to-crypto exchanges

Before concluding this article, we would like to mention two other groups of exchange, “pure fiat-to-crypto exchanges and specialized exchanges”.

We call the first group “pure” fiat-to-crypto exchanges as many centralized exchanges that we have already discussed also allow fiat-to-crypto trading and are thus per definition also fiat-to-crypto exchanges.

What we are talking about when we talk about “fiat” is regular money, i.e. non-cryptocurrency currency. Fiat actually means “let it be done”, and the expression “fiat currency” comes from the thought that we give non-cryptocurrency currency value because politicians and society has told us that it has value. They have simply said “let it be done” and value has been given to it.

The pure fiat-to-crypto exchanges allows you to enter the cryptocurrency market easily. They are thus also entry-level exchanges. In exchange for giving you an easy access, the price that you can buy the Bitcoin or other cryptocurrency you want to buy for is often substantially higher than the market price. Examples of pure fiat-to-crypto exchanges are: Coinbase, BitPanda, Bitprime, Bitrush, Coincorner, CoinMama, Indacoin.

Specialized exchanges

The final group we will discuss in this article are Specialized exchanges. Specialized exchanges have no single lowest common denominator. The only thing they have in common is that they are different from the previously mentioned types of exchanges. As an example, we can mention Vaultoro.

Vaultoro has a truly unique offering – it exchanges BTC for gold. If you have BTC, you can buy gold. If you have gold, you can buy BTC. At the date of writing this review, Vaultoro stores 0.5 tons of gold for its customers (and 415 BTC), but these figures changes each second as new customers sign up and previous customers withdraw or change their allocation between gold and BTC.

Centralized Exchanges vs Decentralized Exchanges – Concluding thoughts

So, this article has discussed the different bigger types of exchanges there are. We hope that you have learned a bit more about the differences between the different types. Maybe you have even gotten a personal favourite among the different exchange types?

In the next article in this series, we will discuss three very important areas to consider when choosing an exchange:

- Can you trade there?

- How do you deposit money?

- What cryptocurrencies can you trade at the different exchanges?

Richard Ramberg

Richard Ramberg